Lululemon Athletica (LULU) built its name on premium athletic apparel, combining performance, style, and lifestyle appeal. But the brand’s recent performance has been anything but premium. Weak demand in its largest market, the Americas, along with slowing product innovation and rising competition, has dragged U.S. revenue growth down. Last year’s attempts at “newness” with updated colors and sizes failed to spark excitement, leaving Wall Street unimpressed.

Management is now banking on a bold spring 2026 collection — featuring 35% new designs from an untested designer — to breathe life back into the brand. But uncertainty looms. Will these new styles capture attention? Or will the risks of higher fashion and markdowns outweigh potential gains?

Analysts are not convinced, and Bernstein downgraded LULU stock from an “Outperform” to a “Market Perform,” cutting its price target to $190. Analyst Aneesha Sherman cited worsening traffic trends, price markdowns, and a lack of proof points for the new collection, finding it “hard to have conviction in the bull thesis.”

With earnings growth expected to decline this year and competitive pressures mounting, is now the time to sell Lululemon shares? Or can the new collection turn the tide?

About Lululemon Stock

Founded in 1998 and headquartered in Vancouver, Canada, Lululemon designs and markets athletic apparel, footwear, and accessories for men and women. The company’s product range includes pants, shorts, tops, and jackets, targeting consumers pursuing active, healthy lifestyles.

With a market capitalization of $19.05 billion, Lululemon operates globally through company-owned stores, outlets, e-commerce platforms, and partner channels, serving customers across North America, China, and other international markets.

After a pandemic-fueled rally, LULU stock has been slashed by more than half, down 68% from its all-time high of $516.39 achieved in late December 2023. U.S. sales struggles, soft product excitement, and consumers spending selectively have weighed heavily on shares.

Add in fierce competition, tariffs biting e-commerce margins, and slower demand, and the outlook feels muted, dampening investor sentiment. Management is hustling with pricing, vendor talks, and cost cuts, but investors are not buying it yet, pushing shares down 56% on a year-to-date (YTD) basis and 14% over the past three months.

Valuation-wise, LULU stock is looking a lot friendlier than it used to. With a forward price-to-earnings ratio of just 12.8 times, the stock is trading well below its historical levels and even under the sector average. But uncertainty is high. Growth is slowing in its biggest market, and looming tariffs are ready to squeeze margins, keeping the risk dial turned up even as the stock looks cheap.

Lululemon’s Mixed Q2 Results and Cautious Outlook

On Sept. 4, Lululemon dropped its second-quarter results for fiscal 2025, and while the numbers were mixed, shares tumbled nearly 19% the day after as investors wrestled with a sobering outlook amid a softening U.S. apparel backdrop.

Lululemon generated revenue of $2.5 billion, up 7% year-over-year (YOY), slightly missing Wall Street’s expectations. While international growth impressed, with net revenue climbing 22% and comparable sales up 15%, the U.S. business struggled. Americas net revenue edged up just 1%, while comparable sales actually fell 4%. Meanwhile, EPS came in at $3.10, down 1.6% YOY but beating forecasts.

Lululemon continued expanding its footprint, opening 14 net new company-operated stores to reach 784 locations globally at the end of Q2. Cash on hand was healthy at $1.2 billion, and its credit facility had $393.2 million available. Inventories, however, climbed 21% YOY to $1.7 billion, reflecting a mix of cautious demand and stockpiling ahead of expected tariffs.

Looking ahead, the near-term outlook is cautious. For Q3, management expects revenue between $2.47 billion and $2.5 billion, with EPS in the $2.18 to $2.23 range. But full-year guidance hit hardest. Management estimates 2025 revenue between $10.85 billion and $11 billion — just 2% to 4% growth — and EPS between $12.77 and $12.97, a 12% decline from last year. Plus, Lululemon expects a notable impact from the U.S. scrapping the “de minimis” rule, which used to let shipments under $800 slip in duty-free. The guidance slowdown was largely tied to the core U.S. market, alongside an estimated $240 million hit to gross profit from tariffs, pricing, and sourcing challenges.

Analysts tracking Lululemon are not exactly breaking a sweat over its growth. EPS for the current fiscal year is expected to slip nearly 12% YOY to $12.91, with only a modest 1% annual bounce to $13.05 in the next fiscal year.

What Do Analysts Expect for Lululemon Stock?

Lululemon Athletica is firmly in Bernstein’s crosshairs after several quarters of lackluster results in its biggest market. The brokerage firm recently downgraded LULU stock from “Outperform” to “Market Perform,” cutting its price target to $190, citing rising risks and low visibility into the brand’s recovery.

Analyst Aneesha Sherman called out worsening U.S. trends — soft traffic, price markdowns, and uninspiring assortments — while management pins hopes on a “new newness” strategy; Spring 2026 will bring 35% new products from an untested designer in “higher-risk lifestyle categories.”

Lululemon’s China story still shines, but U.S. weakness is dimming the glow. Bernstein remains cautious, waiting for proof that innovation can reignite traffic and pricing. With competition biting, margins tight, and product momentum uncertain, conviction in a bullish thesis feels premature — until the brand finds fresh fuel to stretch beyond its slowing stride.

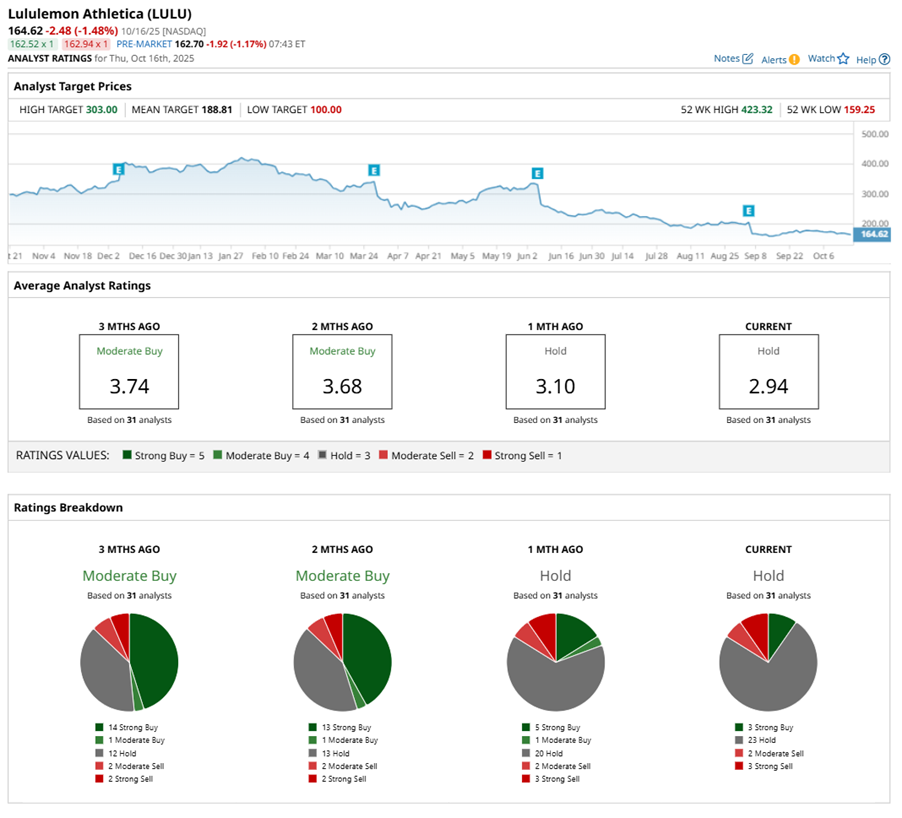

Overall, analysts are cautious about LULU, giving the stock a consensus rating of “Hold." That’s a downgrade from a “Moderate Buy” rating three months ago. Out of the 31 analysts covering the stock now, three suggest a “Strong Buy,” 24 advise a “Hold,” two have a “Moderate Sell,” and two analysts give a “Strong Sell” rating.

The average analyst price target for LULU is $189.32, indicating potential upside of 13%. The Street-high target price of $303 suggests that the stock could rise as much as 81% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart