The artificial intelligence (AI) boom has turned enterprise software into the backbone of modern business, powering automation, analytics, and efficiency at scale. And California-based software maker ServiceNow (NOW) has ridden that wave impressively. The cloud workflow powerhouse is redefining how companies run and streamline digital operations.

Fueled by AI-driven demand, ServiceNow recently posted a stunning Q3 earnings report that blew past Wall Street expectations and showcased its growing dominance in enterprise automation.

Simultaneously, the company made headlines by announcing its first-ever 5-for-1 stock split, pending shareholder approval in December. The move aims to make the high-priced stock more accessible to a broader pool of investors. Stock splits often boost liquidity and signal management’s confidence in long-term growth.

Despite ServiceNow’s strong momentum and renewed analyst enthusiasm, the stock is in the red this year. So, could this be the buying window investors have been waiting for?

About ServiceNow Stock

Founded in 2004, Santa Clara-based ServiceNow is transforming enterprises worldwide. The company delivers end-to-end intelligent workflow automation through its Now Platform, leveraging AI and machine learning to streamline IT services, operations, and risk management. From asset management to customer support, ServiceNow’s platform empowers industries such as finance, healthcare, and technology to operate more efficiently. With a market cap of $182.96 billion and a global presence, it remains a powerhouse in enterprise digital transformation.

ServiceNow’s AI capabilities integrate seamlessly with leading cloud providers, large language models, and enterprise data sources, serving as a “control tower” for modern businesses. Its innovative pricing model – blending subscription and consumption-based structures – enhances flexibility while boosting revenue through offerings like the popular Pro Plus tier. Internally, ServiceNow uses AI to eliminate repetitive tasks and “retool” its workforce, mirroring the transformation it delivers to customers worldwide.

Shares of the workflow automation software provider have skyrocketed more than 920% over the past decade and nearly 115% in the last three years, a testament to its dominance in enterprise software. Yet 2025 has not been all smooth sailing. Despite stellar business execution, NOW stock is down 19% on a year-to-date (YTD) basis, reflecting broader pressure across the software sector and lingering slowdown fears.

The software giant’s stock is not cheap, trading at 90.8 times forward earnings and 16.81 times sales. That’s a hefty premium next to the broader technology sector. But that’s the price investors pay for a front-row seat in the enterprise AI revolution. The company has earned its premium, riding consistent growth, fat margins, and a reputation as a must-have digital workflow engine for global businesses.

ServiceNow’s Stellar Q3 Results

ServiceNow’s third-quarter performance reminded Wall Street why it’s become a cornerstone of enterprise AI transformation. On Oct. 29, the workflow automation giant posted results that topped every major metric, powered by surging demand for its AI-driven tools like Now Assist and Workflow Data Fabric. Revenue jumped 22% year-over-year (YOY) to $3.4 billion, while EPS rose 29.6% annually to $4.82, beating estimates.

Subscription revenue climbed 21.5% annually to $3.3 billion, underscoring its powerful recurring engine and strong enterprise loyalty across industries.

Growth was widespread, especially in the U.S. Federal segment, with major enterprises scaling up digital transformation projects. Non-GAAP current remaining performance obligations (CRPO) hit $11.27 billion, up 20.5%, beating the company’s guidance by 250 basis points, while total RPO climbed to $24.1 billion. The company also closed 103 deals above $1 million in new annual contract value (ACV), and now counts 553 customers contributing over $5 million in ACV, marking 18% YOY growth.

Looking ahead, management guided Q4 subscription revenue between $3.42 billion and $3.43 billion, reflecting 19.5% growth, and between 17.5% and 18% on a constant currency basis. However, management cautioned that on-premise renewals could weigh slightly on subscription growth in Q4. As CFO Gina Mastantuono noted, “on-prem is definitely a factor a bit in Q4,” indicating a short-term headwind as customers transition from older on-premises setups to the cloud.

Even so, management remains confident. For the full year, it expects subscription revenue between $12.835 billion and $12.845 billion, up 20.5% and representing 20% annual growth on a constant currency basis. Margins are expected to stay solid - 83.5% in subscription gross profit, 31% margin from income from operations, and 34% in free cash flow.

Analysts tracking ServiceNow anticipate its fiscal 2025 EPS to be around $9.78, representing 35.8% YOY growth, and then surge by another 21.5% to $11.88 in fiscal 2026.

What Do Analysts Expect for ServiceNow Stock?

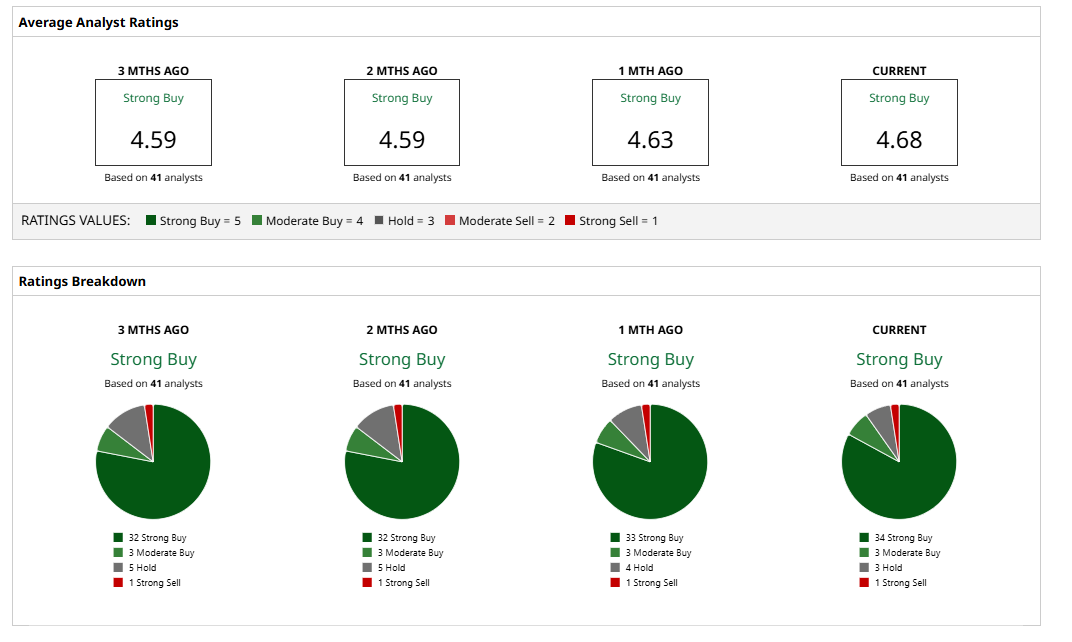

ServiceNow’s shares have stalled this year, but Wall Street’s confidence remains unshaken, with the stock having a “Strong Buy” rating overall. Out of 41 covering the fintech stock, 34 advise a “Strong Buy” and three recommend a “Moderate Buy.” Meanwhile, just three analysts are cautious with a “Hold,” while just one marks it as a “Strong Sell.”

NOW stock’s average analyst price target of $1,159.94 implies upside potential of 35%. The Street-high target price of $1,332 suggests the stock could surge as much as 55% from here.

Conclusion

Stock splits often feel like a celebration – a company’s way of signaling that it has reached a milestone worth sharing. ServiceNow’s 5-for-1 split fits that description perfectly, arriving on the heels of stellar earnings and long-term, unshakable momentum.

The move may steal headlines, but it’s ultimately a reflection of how far the company has climbed in the AI-powered enterprise software boom. While the split could widen ServiceNow’s investor base, boost liquidity, and draw fresh attention from Wall Street, it does not alter the company’s fundamentals, it simply repackages success into smaller, more accessible slices. Although fractional investing has reduced the barrier to entry, a lower price tag still adds psychological appeal for many retail buyers.

A split is cosmetic, and the story underneath is what truly matters. What matters most is ServiceNow’s relentless execution, its growing AI prowess, and the powerful growth engine propelling it forward, not just the share split math.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here