Sysco Corporation (SYY), headquartered in Houston, Texas, is a leading broad-line foodservice distributor in the United States. The company supplies a variety of food and related products, including meat, seafood, dairy, produce, dry goods, frozen foods, kitchen equipment and disposables to restaurants, healthcare and educational institutions, lodging establishments, and other food-away-from-home customers. Sysco’s market cap is around $34.9 billion.

Shares of the food distribution company have lagged behind the broader market over the past 52 weeks. SYY has declined 5.3% over this time frame, while the broader S&P 500 Index ($SPX) has soared 13.4%. Moreover, on a year-to-date (YTD) basis, the stock is down 4.6%, compared to SPX’s 14.3% rise.

Zooming in further, SYY has lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 5% decline over the past 52 weeks and 3.8% dip on a YTD basis.

Sysco Corporation’s shares have been drifting in 2025 primarily because its core U.S. foodservice business is facing weak demand. Also, cost pressures, including inflation on food products and adverse weather events affecting produce supply, are squeezing margins and adding to investor caution.

For fiscal 2026, ending in June, analysts expect Sysco’s EPS to grow 2.5% year over year to $4.57. The company’s earnings surprise history is mixed. It met or exceeded the consensus estimates in three of the last four quarters, while missing on one other occasion.

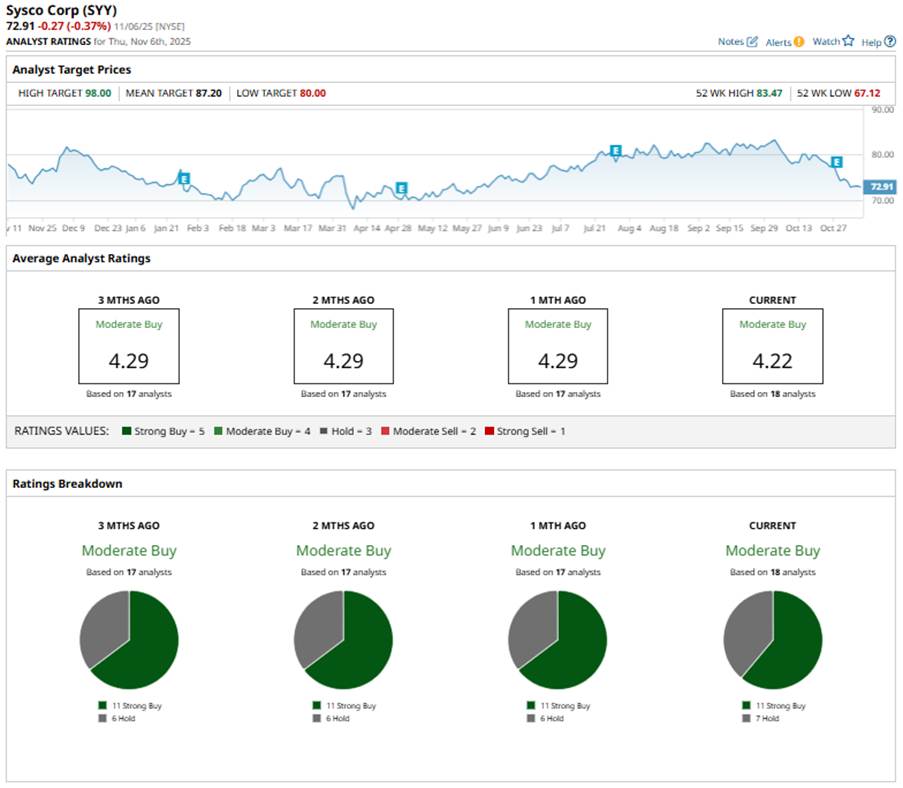

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on 11 “Strong Buys,” and seven “Hold” ratings.

The configuration has remained consistent over the past three months.

Last month, Bernstein initiated coverage on SYY stock with a “Market Perform” rating and an $83 price target. The research firm views Sysco as a “steady performer,” projecting 4% revenue growth in line with consensus, with most gains expected from international and chain segments.

The mean price target of $87.20 represents a 19.6% premium to SYY’s current price levels, while the Street-high price target of $98 suggests an upside potential of 34.4%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue?

- These 3 Tech Stocks Have Been Red-Hot in 2025 but Their Charts Are Screaming ‘Danger’

- Stock Index Futures Slip as Valuation and Economic Concerns Persist, U.S. Confidence Data on Tap

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?