QUEBEC CITY, July 31, 2025 (GLOBE NEWSWIRE) -- West African gold producer and developer Robex Resources Inc (“Robex” or the “Company”) (TSX-V: RBX | ASX: RXR | OTC: RSRBF | Börse Frankfurt: RB4) is pleased to report on its June 2025 Quarter Activities. Robex owns the Nampala Gold Mine in Mali and is progressing well with construction at the Kiniéro Gold Project in Guinea, on schedule for first gold in Q4 CY25.

Highlights:

- Robex commenced trading on the Australian Securities Exchange (ASX) on 5 June 2025 following an oversubscribed Initial public offering (IPO), raising A$120 million (before costs) to fund the Kiniéro Gold Project development and support broader corporate growth initiatives.

- Construction of the Kiniéro Gold Project remained on schedule and on budget during the quarter, with first gold pour targeted for December 2025 quarter. Civil works neared completion and mill installation progressed.

- Operational readiness advanced to plan during the June 2025 quarter, with mining and drill & blast contracts awarded, key site leadership positions filled, and supply chain logistics and consumables procurement nearing completion for initial plant commissioning.

- A total of 61,700 metres of drilling completed at Kiniéro during the June 2025 quarter, supporting ongoing resource development and expansion activities. Drilling at Sabali pit commenced with 16,990 metres drilled as at 30 June 2025 and 84,982 samples collected with results pending.

- Robex incurred development capital expenditure of CAD$65.3 million at Kiniéro during the June 2025 quarter, bringing year-to-date expenditure to CAD$99.2 million. Total project capital remains on budget and is expected to fall within the announced guidance range of CAD$210 million to CAD$225 million.

- Nampala remains Lost Time Injury (LTI) free, with more than 1.27 million hours worked. Kiniéro has recorded 3.67 million LTI-free hours since January 2023.

- Nampala produced 11,736 ounces and sold 13,104 ounces of gold during the June 2025 quarter.

- Year-to-date gold production from Nampala totalled 24,628 ounces at an All-in Sustaining (AISC) of CAD$2,228 per ounce.

- Nampala remains on track to meet full-year FY25 production guidance of 46,000 to 48,000 ounces.

Robex’s Managing Director and CEO Matt Wilcox commented:

“We’ve made a tremendous amount of progress at Kiniéro through the June quarter and remain on track for first gold at the project in Q4. Our teams continue to work safely and responsibly, and our project is lost-time-injury free to 30 June, even as construction activity ramps up. SAG mill installation is underway, work on the CIL tanks continues and process plant SMP works have commenced.

“Completion of our A$120 million initial public offer and listing on the ASX was another major achievement during the quarter and a milestone that was many months in the making. I thank all team members who were involved in this process as well as investors and other stakeholders who supported us on this journey.

“Meanwhile our Nampala Gold Mine in Mali continues production at a steady pace.”

Kiniéro Gold Project, Guinea

Construction Overview

The Kiniéro Project remains firmly on track for commissioning in Q4 2025. Key engineering and procurement milestones were completed in Q2, with site progress focused on mechanical and structural installation.

Process Plant & CIL

- Reclaim chamber suspended slab was poured during the quarter, completing all major concrete pours.

- CIL Tanks Train A was completed, including all internal components and intertank lauders. CIL Tanks Train B floor and shells are fully completed with internal and intertank launders outstanding.

- Concrete works on water services commenced and will be completed by late July 2025.

- Mill installation crew mobilised to site and commenced the SAG mill installation. Centrelines were surveyed and marked, and baseplates were installed. On the SAG mill, the bottom half of the ring gear guard was placed and the jacking cradle for the SAG mill shells was positioned.

- Process plant SMP works commenced during the quarter, with structural erection of the pipe racks and mill feed end suspended slab also completed. Robex has erected 188 tonnes of steel to date.

Figure 1: Aerial view of the Kiniéro site showing process plant and infrastructure (26 June 2025)

Tailings Storage Facility (TSF)

- A total of 800,000m2 HDPE lining for the TSF was installed to RL 419. The lining crew demobilised and will remobilise in mid-October, after the rainy season.

- Eastern embankment construction continues when weather permits.

- Tailing pipeline containment channel earthwork commenced.

Power Generation & Fuel Infrastructure

- Concrete poured for all eight power station engine bases, including the power station control/switch room.

- Power station concrete progressing; expected completion in early August 2025.

- Structural steel and platework fabrication nearing completion.

- SMP (Structural, Mechanical & Piping) works progressing well.

Other Infrastructure

- Overland HDPE piping welding work commenced.

- A road to the river extraction tower is being prepared, with installation of piping and concrete tower in early July.

- Construction of haul roads has commenced, with a haul road from the ROM pad to the MSA cleared.

- Kouroussa Road upgrade work has commenced and will be completed by late July.

Construction Next Steps – Q3 2025

In the quarter ahead, Robex expects to:

- Complete remaining concrete pours and CIL Train B.

- Continue mill and plant installation.

- Award all remaining contracts.

- Complete all field fabricated tanks for the process plant.

- Complete all building infrastructure.

- Continue with the TSF embankment construction.

- Mobilise power station SMP installation contract and commence works.

- Mobilise Electrical and Instrumentation installation crew.

- Complete collection of all materials and equipment and delivery to site.

- Prepare for Kiniéro commissioning.

Environmental and Safety Performance

At the in-development Kiniéro Project, Robex maintained strong environmental and health & safety practices during the quarter, reinforcing its commitment to responsible mining and early-stage community engagement. This proactive approach included:

- Safety performance remained strong, with no lost time injuries (LTIs) recorded during the quarter.

- Ensuring continuous oversight of waste transportation protocols to ensure regulatory compliance disposals facilities.

- Implemented comprehensive plastic waste collection campaign across site.

- Established environmental management and pollution prevention as a core priority, targeting zero externally reportable environmental non-compliance incidents.

- Construction project maintains commitment to zero externally reportable environmental non-compliance incidents.

Kiniéro Operational Readiness

Direct Components (on track)

- Leadership Appointments:

Recruitment of Kiniéro General Manager and Chief Geologist is complete. The Chief Geologist will commence in July and the GM in mid-August. Operational readiness planning is underway.

- Mining Contract:

This is now finalised and ready for signature. Contractor mobilisation has begun, with logistics planning advanced.

- Drill & Blast Contract:

This contract is under final legal review. Explosives magazine licensing has been completed; site facility construction is beginning in July.

- Secondary Haulage:

Tendering for this contract is completed. Shortlisted contractors undergoing due diligence and clarification.

Indirect Components (on track)

- Health, Safety & Environment (HSE):

Appointment of an Environmental Superintendent has expanded this team. Safety system reviews and ICAM training provider selection are in progress.

- Finance:

Operational budgeting and internal financial control frameworks are being implemented to support transition to steady-state operations.

- Supply Chain:

Contract finalisation for key operational services is ongoing. Planning for first fills and consumables is underway, alongside recruitment and customs/logistics capability building.

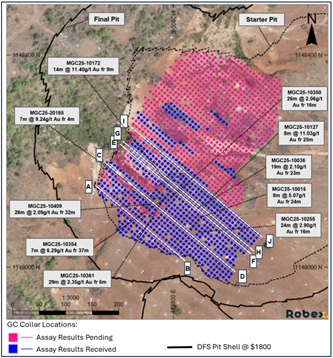

Advanced Grade Control Drilling

The advanced grade control drilling program at the Mansounia deposit, part of the Kiniéro Gold Project in Guinea, continues to deliver strong results ahead of first gold production targeted for Q4 2025. As announced on 10 July 2025, the program comprised 1,605 inclined RC drill holes totalling 66,000 metres, designed to refine the resource model in near-surfaces zones and inform early-stage mine planning.

Assay results received to date confirm mineralization consistent with the resource block model. High-grade intercepts, including 14m @ 11.40g/t Au and 8m @ 11.03g/t Au, further support the robustness of the deposit and increase confidence in the initial production schedule.

Figure 2: Grade control drill locations over the Mansounia Deposit for an initial three months of mining

June Quarter Progress at Kiniéro Gold Project, Guinea

Figure 3: Reclaim Chamber – Suspended Slab Poured

Figure 4: Aerial view of Tailings storage facility

Figure 5: Grinding

Figure 6: Grinding and CIL Tank Erection

Figure 7: Power Station – Concrete poured for 8 engine bases

Figure 8: Aerial view of process plant and infrastructure

Nampala Gold Operation, Mali

Production and Financial Summary1

| 2025 | 2024 | |||||

| (in thousands of Canadian dollars) | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 |

| Revenues – Gold sales | 60,099 | 49,373 | 41,827 | 38,059 | 39,318 | 39,183 |

| Mining Income | 29,502 | 21,943 | 22,683 | 15,466 | 18,039 | 17,242 |

| Operating Income or (Loss)2 | (24,018) | 16,259 | 9,526 | 10,065 | 11,518 | 11,755 |

| Net Profit or (Loss) | (34,346) | (29,239) | (2,790) | 22,462 | (188) | (32,082) |

| Net income (loss) attributable to: | ||||||

| - Common shareholders | (37,449) | (29,561) | (2,724) | 20,286 | (1,639) | (29,134) |

| - Non-controlling interests | 3,103 | 322 | (66) | 2,176 | 1,451 | (2,948) |

| Basic earnings per share | (0.172) | (0.182) | (0.018) | 0.134 | (0.018) | (0.322) |

| Diluted earnings per share | (0.172) | (0.182) | (0.018) | 0.134 | (0.018) | (0.322) |

| Cash flows from operating activities | (34,195) | 17,221 | 21,427 | (7,920) | 12,480 | 20,907 |

| Operating data | ||||||

| Ore mined (‘000 tonnes) | 548 | 559 | 533 | 473 | 546 | 551 |

| Head grade (g/t) | 0.76 | 0.82 | 0.73 | 0.75 | 0.83 | 0.82 |

| Recovery (%) | 87.3 | 87.6 | 87.3 | 88.3 | 87.9 | 89.5 |

| Ounces of gold produced | 11,736 | 12,892 | 10,963 | 10,031 | 12,764 | 12,957 |

| Ounces of gold sold | 13,104 | 11,859 | 11,180 | 11,163 | 12,150 | 14,071 |

| Statistics (in Canadian dollars) | ||||||

| Average realised selling price (per ounce of gold) | 4,586 | 4,160 | 3,741 | 3,409 | 3,236 | 2,785 |

| Cash operating cost (per tonne processed) | 19 | 20 | 20 | 21 | 20 | 17 |

| Total cash cost (per ounce of gold sold) | 1,475 | 1,537 | 1,130 | 1,009 | 855 | 801 |

| All-in sustaining cost (per ounce of gold sold) | 2,125 | 2,342 | 1,768 | 1,437 | 1,171 | 1,134 |

1 Financial figures are unaudited and based on information available as at the release of the 30 June 2025 Quarterly Activities Report.

2 The operating loss for the quarter primarily reflects a CAD $20 million Disposal of subsidiary – Africa Peak Trading House Limited and a CAD $21.6 million settlement relating to the Sycamore acquisition. For further details, refer to the corporate section of this 30 June 2025 Quarterly Activities Report.

| Three months ending 30 June | Six months ending 30 June | |||

| 2025 | 2024 | 2025 | 2024 | |

| OPERATING DATA | ||||

| Ore mined (tonnes) | 720,924 | 753,057 | 1,352,440 | 1,433,615 |

| Waste mined (tonnes) | 1,964,119 | 1,020,529 | 4,334,688 | 2,110,430 |

| Operational stripping ratio | 2.7 | 1.4 | 3.2 | 1.5 |

| Ore processed (tonnes) | 547,749 | 545,600 | 1,106,762 | 1,096,821 |

| Head grade (g/t) | 0.76 | 0.83 | 0.79 | 0.83 |

| Recovery (%) | 87.3 | 87.9 | 87.5 | 87.9 |

| Ounces of gold produced | 11,736 | 12,764 | 24,629 | 25,721 |

| Ounces of gold sold | 13,104 | 12,150 | 24,963 | 26,222 |

| STATISTICS | ||||

| Average realised selling price (per ounce of gold sold) | 4,586 | 3 236 | 4,384 | 2 994 |

| Cash operating cost (per tonne processed) | 19 | 20 | 20 | 18 |

| Total cash cost (per ounce of gold sold) | 1,475 | 855 | 1,505 | 826 |

| All-in sustaining cost (per ounce of gold sold) | 2,125 | 1,171 | 2,228 | 1 151 |

| Adjusted all-in sustaining cost (per ounce of gold sold) | 1,511 | 870 | 1,555 | 862 |

| Administrative expenses (per ounce of gold sold) | 421 | 245 | 365 | 218 |

- Material Mined: For the three months ended June 30, 2025, total materials mined was 2,685,043 tonnes, comprising 1,964,119 tonnes of waste and 720,924 tonnes of ore. The operational stripping ratio was 2.7, compared to 1.4 in the prior corresponding period, reflecting a higher waste movement to access ore.

- Ore Processed: Throughput performance improved marginally, with 545,600 tonnes of ore processed – up 0.4% to 547,749 tonnes in the quarter ended June 30, 2025. This increase was achieved despite unplanned downtime related to cone crusher and mineral sizer. The improvement was primarily driven by favourable ore characteristics, which enabled smoother mill operation and supported a higher average daily throughput of 6,019 tonnes per day, compared to 5,996 tonnes per day in the prior corresponding period.

- Head Grade: Slightly diluted by 0.07 g/t, decreasing from 0.83 g/t to 0.76 g/t in quarter ended June 30, 2025. This decrease is attributed to a higher portion of low-grade ore processed during the 2025 quarter.

- Recovery rate: Decreased by 0.06%, from 87.9% in the quarter ended June 30, 2024 to 87.3% in the 2025 quarter. This decrease is attributed to lower recovery in April (85.7%) due to a higher proportion of transitional ore in the mill feed and above-design processing rates.

- Gold Production: Due to a combination of factors, including a decline in ore recovery rate and grade, gold production decreased by 1,208 ounces in the quarter ended June 30, 2025, compared to the quarter ended June 30, 2024, representing a decline of 8.1% in total gold output.

- Availability Rate and Shutdowns: Availability for the quarter ended June 30, 2025 was 90.4%, slightly lower than 92.2% in the quarter ended June 30,2024, due to a total of 94 hours of unplanned shutdowns primarily related to mechanical maintenance and minor infrastructure repairs. Despite these interruptions, strong operational performance was maintained, with production output remaining resilient throughout the period.

- Total Cash Cost: Increased by $620 per ounce, or 72.5%, in the quarter ended June 30, 2025, compared to the prior corresponding period in 2024. The increase was primarily driven by the implementation of a new agreement with the Malian authorities, which introduced additional taxes impacting mining royalties. This impact was partially offset by a higher volume of gold sold during the period.

- All-in Sustaining Cost: The all-in sustaining cost (AISC) per ounce of gold increased significantly in the quarter ended June 30, 2025 – up 81.5% to $2,125 per ounce, compared to $1,171 in the prior corresponding period. This increase was primarily driven by a sharp rise in the total cash costs (+86.2%) due to the higher mining royalties under new fiscal terms, and a 121.8% increase in sustaining capital expenditures, reflecting investment in mine infrastructure and equipment. Despite a 7.9% increase in ounces of gold sold, the cost escalation outpaced production growth, resulting in a higher unit cost per ounce.

Environmental and Safety Performance

Robex maintained strong environmental and health & safety performance at the Nampala Mine during the quarter, reinforcing its commitment to responsible mining and community engagement. This included:

- Safety performance remained strong, with no lost time injuries (LTIs) recorded during the quarter.

- No reportable environmental incidents or breaches recorded.

- Dust suppression activities continued, including the application of molasses to haul roads.

- Plastic waste recovery programs continued, with enhanced collection points and secure disposal.

- Environmental monitoring programs are in place for water quality, air quality, and noise management.

- Continued operation of water supply infrastructure and maintenance of village pumps.

- Initiated an environmental rehabilitation program with more than 50,000 trees planted on waste dump areas visible from Nampala village.

- Expanded community engagement through plantation initiatives at local schools and public facilities.

- Evaluating opportunities to improve process water recycling and reduce solid waste disposal to minimise environmental footprint.

CORPORATE

Disposal of subsidiary – Africa Peak Trading House Limited

On 1 May 2025, Robex’s wholly owned subsidiary, African Peak trading house Limited (APTH), domiciled in the Isle of Man, was formally dissolved. In accordance with IFRS 10 Consolidated Financial Statements, Robex’s shares in APTH were consolidated within the Group’s condensed interim consolidated statement of loss up to the date of dissolution.

A non-cash loss of CAD$20.0 million was recognized in the condensed interim consolidated statement of loss under “Other Expenses”, reflecting the derecognition of APTH. The closure of APTH aligns with Robex’s strategic objective to streamline its operational framework and simplify the Group’s overall corporate structure.

Settlement relating to Sycamore acquisition

In April 2025, Robex reached a settlement with certain vendors in connection with the April 2022 acquisition of the Sycamore Group. As part of the settlement, on 14 April 2025, the Company agreed to the early issue of the final tranche of 10,090,000 shares due under the Share Purchase Agreement (SPA) (equivalent to 100,900,000 common shares of Robex on a pre-consolidation basis, per the initial SPA).

Additionally, Robex agreed to pay CAD $1.0 million in cash, with CAD $0.25 million payable three months after settlement and CAD $0.75 million payable six months after settlement. Robex issued 12,500,000 common share warrants with an exercise price of CAD $2.75 per share and three-year term. The cash warrant components were not part of the original acquisition consideration and have been recognized as legal settlement expenses in profit or loss.

Completion of A$120m IPO and ASX listing

Robex successfully listed on the ASX under the code ‘RXR’ on 5 June 2025, after raising A$120 million (CAD$107.9 million) via the issue of 38,585,209 CHESS Depository Interests (CDIs) at A$3.11 in its Initial Public Offer (IPO). Proceeds are allocated to Kiniéro construction, working capital and corporate overheads.

Sprott Facility

Robex has a US$130 million (CAD$177.9 million) facility in place with Sprott Resource Lending (US Manager) Corp., (Sprott) as agent and lead arranger to fund construction at Kiniéro and working capital. Robex completed first drawdown of this facility US$25 million (CAD$34 million) in March 2025.

The Facility Agreement was amended on 9 July 2025 to remove the Agent’s rights to exercise the cash sweep. As a result, US$25 million (CAD$34 million) previously held in the Cash Sweep Account was released to Robex. These funds will now support construction activities at the Kiniéro Project. The release of the Cash Sweep Amount to Robex is a positive development for its Guinean operations.

Capital Structure Update

The Company’s issued capital increased from 168,499,931 shares at 31 March 2025 to 218,202,805 shares at 30 June 2025. The shares are dual listed on the ASX (as CDIs) and the TSXV (as common shares).

Key capital movements during the quarter are summarised below:

- 14 April 2025:

The Company issued 10,090,000 common shares as part of a mutual full and final release under the Sycamore Share Purchase Agreement (SPA) and accessory agreements. In connection with the settlement, 12,500,000 warrants were issued, each exercisable at CAD $2.75 and expiring in 36 months. A cash payment of CAD $1.0 million is payable in two instalments: $0.25 million before 5 June 2025 and $0.75 million before 5 September 2025. As the cash and warrants related to a post-acquisition dispute, both are expensed in Q2 2025. The warrants are classified as derivative liabilities under IAS 32 and measured at fair value through profit or loss. In total, the fair value expense of the warrants and associated cash payments amounted to $21.6 million in the second quarter of 2025. - 27 June 2024 (updated as at 30 June 2025):

Robex previously issued 58,294,880 common share purchase warrants, exercisable at C$2.55 until 27 June 2026. The warrants may expire earlier if the Robex share price trades at or above C$3.50 for 10 consecutive trading days.

During the quarter:- 24 April 2025: 6,800 warrants were exercised at C$2.55.

- 16 June 2025: 31,576 warrants were exercised at C$2.55.

- Total outstanding listed warrants 58,256,004.

- 23 May 2025:

The Company completed an initial public offering, issuing 38,585,209 CDIs at an issue price of A$3.11 (C$2.73), raising gross proceeds of A$120 million (C$107.86 million). - 10 June 2025:

A total of 989,289 common shares were issued to SCP Resource Finance LP (SCP) in connection with the termination agreement entered into between the Company and SCP on 28 February 2025 (the SCP Termination Agreement). On 26 September 2023, the Company engaged SCP as financial advisor and under this engagement, SCP previously provided the Company with services linked to capital raisings and transactions. The engagement was terminated and under the SCP Termination Agreement, the Company agreed to pay in consideration for all services already provided by SCP to the Company under the SCP Engagement, a one-time fee of US$2 million payable in common shares at the ASX Offer Price (A$3.11) two business days following admission onto the ASX.

| FY25 Guidance | June Quarter | Year-to-Date | Forecast |

| Nampala Gold Operation | |||

| Gold Production | 11,736 ounces | 24,628 ounces | 46,000 to 48,000 ounces |

| All-in sustaining cost (AISC) (per ounce of gold sold) | $2,125 | $2,228 | <$2,0003 |

| Sustaining CAPEX | $8,518,443 | $18,069,209 | $24 million to $28 million |

| Stripping costs | $7,850,899 | $15,448,117 | $20 million to $24 million |

| Kiniéro Gold Project | |||

| Development Capital Expenditure (Capex) | $65,275,671 | $99,234,612 | $210 million to $225 million |

| Pre-production / Pre-operating | --- | --- | $33 million to $35 million |

3 Mining and production costs remain within guidance; However, ASIC is trending above forecast due to higher royalties associated with increased gold prices. The Group continues to monitor economic conditions and may revise AISC guidance in the September quarter.

The 2025 forecast for sustaining capital is C$24-28 million, and stripping costs are estimated at C$20-24 million.

The following assumptions were used in preparing the 2025 forecast:

- Average realised selling price for gold: C$3,197 per ounce

- Fuel price: C$1.85 per litre

- $USD/$CAD exchange rate: 1.39

Net Debt:

Net debt (net cash position) is a non-IFRS financial measure that represents the total amount of bank indebtedness, including lines of credit, Bridge Loan, long term debt and lease liabilities, less cash at the end of a given period. Management uses this metric to analyze the Company’s debt position and assess the Company’s ability to service its debt. The following table presents a reconciliation to the most directly comparable financial measure in the financial statements, i.e., total liabilities less current assets, for the current and comparative periods. Net debt (net cash position) is calculated as follows:

| As at June 30 | As at December 31 | |

| 2025 | 2024 | |

| C$ | C$ | |

| Lines of credit | --- | 1,120,417 |

| Project financing facility | 15,170,053 | 28,164,224 |

| Lease liabilities | 5,476,695 | 6,376,888 |

| Less:Cash | (21,116,557) | (41,443,440) |

| Net Debt (Net Cash Position) | (469,809) | (5,781,911) |

This announcement was approved and authorised for release by the Company’s Board of Directors.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Robex Resources Inc.

Matthew Wilcox, Managing Director and Chief Executive Officer

Alain William, Chief Financial Officer

Email: investor@robexgold.com

www.robexgold.com

Investors and Media:

Nathan Ryan

NWR Communications

+61 420 582 887

nathan.ryan@nwrcommunications.com.au

Kiniéro Permit Area Details

| Permit No | Type | Mineral | Area (Km2) | Deposit | Current Holding Company | Validity/Status/Duration | |

| 311 | Exploitation Permit | Gold | 95.51 | SMG | Awarded on 17 December 2020. Valid for a period of 15 years renewable on expiry | ||

| 310 | Exploitation Permit | Gold | 37.85 | SMG | Awarded on 17 December 2020. Valid for a period of 15 years renewable on expiry | ||

| 271 | Exploitation Permit | Gold | 99.35 | SMG | Awarded on 4 November 2020. Valid for a period of 15 years, renewable on expiry | ||

| 312 | Exploitation Permit | Gold | 93.63 | Sabali North and Central Sabali South, SGA, Jean and Banfare | SMG | Awarded on 17 December 2020. Valid for a period of 15 years, renewable on expiry | |

Mansounia Exploration Permit Details

| Permit No | Type | Mineral | Area (Km2) | Deposit | Current Holding Company | Status |

| 1048 | Exploration Permit | Gold | 53.78 | Mansounia | Penta Goldfields | Permit awarded on 6 April 2020, valid for an initial period of 3 years and renewable on expiry. An exploitation permit application (to be issued in SMG’s name) was validly submitted to the CPDM in Q1 2023 for 50% of the Mansounia Permit Area. This application is still being processed, but the Company notes that on 7 March 2025 the Guinean Minister of Mines confirmed in writing that the application is complete and compliant. |

| 1049 | Exploration Permit | Gold | 90.37 | Penta Goldfields | Permit awarded on 6 April 2020, valid for an initial period of 3 years and renewable on expiry. An exploitation permit application (to be issued in SMG’s name) was validly submitted to the CPDM in Q1 2023 for 50% of the Mansounia Permit Area. This application is still being processed but the Company notes that on 7 March 2025 the Guinean Minister of Mines confirmed in writing that the application is complete and compliant. |

Nampala Project Exploitation Permit Details

| Permit Code | Permit Name | Start date | Expiry date | Area | Status |

| PE 2011/17 | Nampala exploitation permit (permis D’exploitation de Nampala) | 21 March 2012 | 21 March 2024 | Active |

Nampala Project Exploration Permit Details (South Mali)

| Permit Code | Permit Name | Start date | Area | Status |

| PR: 17/868 | Kamasso | 19 September 2017 | 100km2 | Under renewal process |

| PR 16/802 Bis 1 | Diangounté | 28 November 2017 | 52km2 | Under renewal process |

| PR:19/1038 | Sanoula | 28 August 2019 | 31.5km2 | Under renewal process |

| PR: 19:/1039 | Mininko | 17 September 2019 | 46.20km2 | Under renewal process |

| PR: 20/1088 | Gladié | 31 March 2021 | 52km2 | Under renewal process |

Competent Person's Statement

Information in this Announcement that relates to exploration results is based on, and fairly represents, information and supporting documentation prepared by Mr. Amir Adeli, a Competent Person who is a Member of the Australian Institute of Mining and Metallurgy. Mr Adeli has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Adeli is an employee of Robex Resources Management Limited and consents to the inclusion in this announcement of all technical statements based on his information in the form and context in which it appears.

Previously reported information

The Company’s Kiniero Project exploration results are extracted from the Company’s ASX announcement 10 July 2025 “Kiniero Grade Control Drilling Continue to Return High-Grade Gold Results” – available at www.robexgold.com or www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the information included in these market announcements. The Company confirms that the form and content in which the Competent Person's findings are presented here have not been materially modified from the original market announcement. Refer to www.robexgold.com for details on past exploration results and Mineral Resource Estimates.

FORWARD-LOOKING INFORMATION AND FORWARD-LOOKING STATEMENTS

Certain information set forth in this news release contains “forward-looking statements” and “forward-looking information” within the meaning of applicable Canadian securities legislation (referred to herein as “forward-looking statements”). Forward-looking statements are included to provide information about the Company’s management’s (“Management’s”) current expectations and plans that allow investors and others to have a better understanding of the Company’s business plans and financial performance and condition.

Statements made in this news release that describe the Company’s or Management’s estimates, expectations, forecasts, objectives, predictions, projections of the future or strategies may be “forward-looking statements”, and can be identified by the use of the conditional or forward-looking terminology such as “aim”, “anticipate”, “assume”, “believe”, “can”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “guide”, “indication”, “intend”, “intention”, “likely”, “may”, “might”, “objective”, “opportunity”, “outlook”, “plan”, “potential”, “should”, “strategy”, “target”, “will” or “would” or the negative thereof or other variations thereon. Forward-looking statements also include any other statements that do not refer to historical facts. In particular and without limitation, this news release contains forward-looking statements pertaining to the Facility Agreement, including the fulfilment of the conditions precedent thereunder, the ability of the Company to utilize any proceeds from the Initial Utilization, the ability of the Company to draw down on the Debt Facility for each Subsequent Utilization, the development of the Kiniero Gold Project and the issuance of Bonus Shares.

Forward-looking statements and forward-looking information are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such statements or information. There can be no assurance that such statements or information will prove to be accurate. Such statements and information are based on numerous assumptions, including: the ability to execute the Company’s plans relating to the Kiniero Gold Project as set out in the feasibility study with respect thereto, as the same may be updated, the whole in accordance with the revised timeline previously disclosed by the Company; the Company’s ability to complete its planned exploration and development programs; the absence of adverse conditions at the Kiniero Gold Project; the absence of unforeseen operational delays; the absence of material delays in obtaining necessary permits; the price of gold remaining at levels that render the Kiniero Gold Project profitable; the Company’s ability to continue raising necessary capital to finance its operations; the ability of the Company to realize on the mineral resource and mineral reserve estimates; assumptions regarding present and future business strategies, local and global geopolitical and economic conditions and the environment in which the Company operates and will operate in the future; the Company’s ability to complete the listing of its common shares on the Australian Securities Exchange (ASX), and the anticipated timing of such listing; satisfaction of the conditions precedent under the Facility Agreement; the Borrower’s access to the facility made available under the Facility Agreement; and the utilisation of any amount received by the Borrower under the Facility Agreement for the purposes identified by the Company.

Certain important factors could cause the Company’s actual results, performance or achievements to differ materially from those in the forward-looking statements including, but not limited to: the risk that the Borrower is unable to fulfil the conditions precedent to drawdowns under the Facility Agreement, and is therefore not able to borrow some or all of the principal amount otherwise available under the Facility Agreement; the risk that the Company is unable to generate sufficient cash flow or complete subsequent debt or equity financings to allow it to repay amounts borrowed under the Facility Agreement; the risk that the obligors under the Facility Agreement are unable to comply with the financial and other covenants under the Facility Agreement, giving rise to an event of default; geopolitical risks and security challenges associated with its operations in West Africa, including the Company’s inability to assert its rights and the possibility of civil unrest and civil disobedience; fluctuations in the price of gold; uncertainties as to the Company’s estimates of mineral reserves and mineral resources; the speculative nature of mineral exploration and development; the replacement of the Company’s depleted mineral reserves; the Company’s limited number of projects; the risk that the Kiniero Gold Project will never reach the production stage (including due to a lack of financing); the Company’s capital requirements and access to funding; changes in legislation, regulations and accounting standards to which the Company is subject, including environmental, health and safety standards, and the impact of such legislation, regulations and standards on the Company’s activities; equity interests and royalty payments payable to third parties; price volatility and availability of commodities; instability in the global financial system; uncertainty surrounding the imposition of tariffs by one country, including, but not limited to, the United States, on goods or services being imported into that country from another country and the ultimate effect of such tariffs on the Company’s supply chains; the effects of high inflation, such as higher commodity prices; fluctuations in currency exchange rates, particularly as between the Canadian dollar, in which the Company presently raises its equity financings, and the US dollar; the risk of any pending or future litigation against the Company; limitations on transactions between the Company and its foreign subsidiaries; volatility in the market price of the Common Shares; tax risks, including changes in taxation laws or assessments on the Company; the Company obtaining and maintaining titles to property as well as the permits and licenses required for the Company’s ongoing operations; changes in project parameters and/or economic assessments as plans continue to be refined; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; the effects of public health crises on the Company’s activities; the Company’s relations with its employees and other stakeholders, including local governments and communities in the countries in which it operates; the risk of any violations of applicable anticorruption laws, export control regulations, economic sanction programs and related laws by the Company or its agents; the risk that the Company encounters conflicts with small-scale miners; competition with other mining companies; the Company’s dependence on third-party contractors; the Company’s reliance on key executives and highly skilled personnel; the Company’s access to adequate infrastructure; the risks associated with the Company’s potential liabilities regarding its tailings storage facilities; supply chain disruptions; hazards and risks normally associated with mineral exploration and gold mining development and production operations; problems related to weather and climate; the risk of information technology system failures and cybersecurity threats; the risk that the Company is not able to complete the listing of its common shares on the ASX within the anticipated timeframe or at all; the risk that the Borrower is not able to access the proceeds of the Debt Facility or use any amount received under the Facility Agreement for the purposes identified by the Company; and the risk that the Company may not be able to insure against all the potential risks associated with its operations.

Although the Company believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. These factors are not intended to represent a complete and exhaustive list of the factors that could affect the Company; however, they should be considered carefully. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information.

The Company undertakes no obligation to update forward-looking information if circumstances or Management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking information.

The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results as at and for the periods ended on the dates presented in the Company’s plans and objectives, and may not be appropriate for other purposes.

See also the “Risk Factors” section of the Company’s Annual Information Form, available under the Company’s profile on SEDAR+ at www.sedarplus.ca or on the Company’s website at www.robexgold.com, for additional information on risk factors that could cause results to differ materially from forward-looking statements. All forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

The Company has prepared this announcement based on information available to it. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions or conclusions contained in this announcement. To the maximum extent permitted by law, none of the Company, its directors, officers, employees, associates, advisers and agents, nor any other person accepts any liability, including, without limitation, any liability arising from fault or negligence on the part of any of them or any other person, for any loss arising from the use of this announcement or its contents or otherwise arising in connection with it.

This announcement is not an offer, invitation, solicitation, or other recommendation with respect to the subscription for, purchase or sale of any security, and neither this announcement nor anything in it shall form the basis of any contract or commitment whatsoever.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/250ee22c-9f10-4bd3-95e7-501476f6977f

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ab72d26-0371-4395-915a-415db44be52d

https://www.globenewswire.com/NewsRoom/AttachmentNg/cddd34ae-08e4-4091-9017-ec815615403b

https://www.globenewswire.com/NewsRoom/AttachmentNg/be83005a-ca76-468e-b6a6-bde5038e766a

https://www.globenewswire.com/NewsRoom/AttachmentNg/bbe864a4-edb6-4647-822d-5d3257a06b21

https://www.globenewswire.com/NewsRoom/AttachmentNg/4610f38c-e4de-4fde-abf3-0ad795e372e3

https://www.globenewswire.com/NewsRoom/AttachmentNg/04c144f5-68e0-49d2-8666-a0389f1d549d

https://www.globenewswire.com/NewsRoom/AttachmentNg/85fd3644-6731-4a23-baa4-16e455ba1782