Wrapping up Q4 earnings, we look at the numbers and key takeaways for the engineered components and systems stocks, including Timken (NYSE:TKR) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a satisfactory Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.1% since the latest earnings results.

Timken (NYSE:TKR)

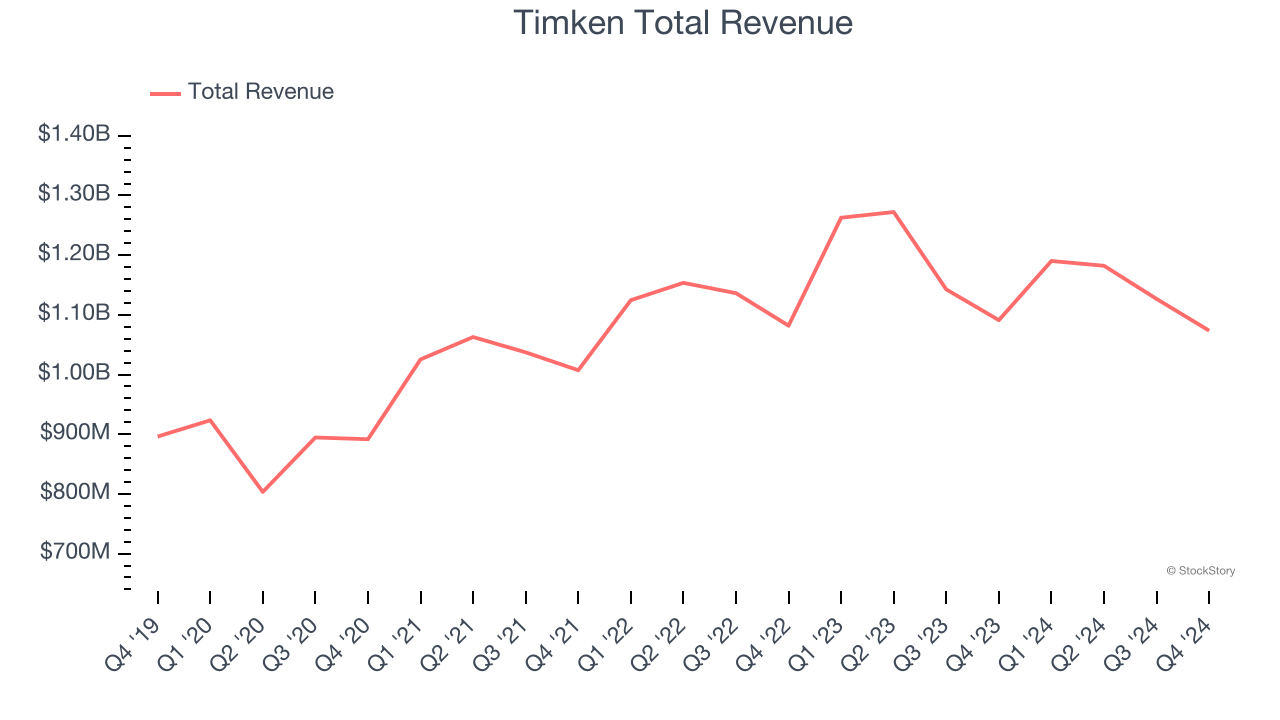

Established after the founder noticed the difficulty freight wagons had making sharp turns, Timken (NYSE:TKR) is a provider of industrial parts used across various sectors.

Timken reported revenues of $1.07 billion, down 1.6% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

"We delivered a good finish to the year with strong cash flow in the fourth quarter," said Tarak Mehta, president and chief executive officer.

The stock is down 5.7% since reporting and currently trades at $74.52.

Is now the time to buy Timken? Access our full analysis of the earnings results here, it’s free.

Best Q4: ESCO (NYSE:ESE)

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE:ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

ESCO reported revenues of $247 million, up 13.2% year on year, outperforming analysts’ expectations by 2.8%. The business had a stunning quarter with EPS guidance for next quarter exceeding analysts’ expectations.

ESCO delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 20.1% since reporting. It currently trades at $158.96.

Is now the time to buy ESCO? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Regal Rexnord (NYSE:RRX)

Headquartered in Milwaukee, Regal Rexnord (NYSE:RRX) provides power transmission and industrial automation products.

Regal Rexnord reported revenues of $1.46 billion, down 9.1% year on year, falling short of analysts’ expectations by 1.9%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 23.8% since the results and currently trades at $118.05.

Read our full analysis of Regal Rexnord’s results here.

Applied Industrial (NYSE:AIT)

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE:AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

Applied Industrial reported revenues of $1.07 billion, flat year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 9.7% since reporting and currently trades at $227.33.

Read our full, actionable report on Applied Industrial here, it’s free.

Enpro (NYSE:NPO)

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE:NPO) designs, manufactures, and sells products used for machinery in various industries.

Enpro reported revenues of $258.4 million, up 3.7% year on year. This print topped analysts’ expectations by 3.3%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

Enpro pulled off the biggest analyst estimates beat among its peers. The stock is down 9.6% since reporting and currently trades at $176.54.

Read our full, actionable report on Enpro here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.