Over the past six months, Incyte’s shares (currently trading at $60.02) have posted a disappointing 11.8% loss while the S&P 500 was down 1.7%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Incyte, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Incyte. Here are three reasons why there are better opportunities than INCY and a stock we'd rather own.

Why Is Incyte Not Exciting?

Founded in 1991 and evolving from a genomics research firm to a commercial-stage drug developer, Incyte (NASDAQ:INCY) is a biopharmaceutical company that discovers, develops, and commercializes proprietary therapeutics for cancer and inflammatory diseases.

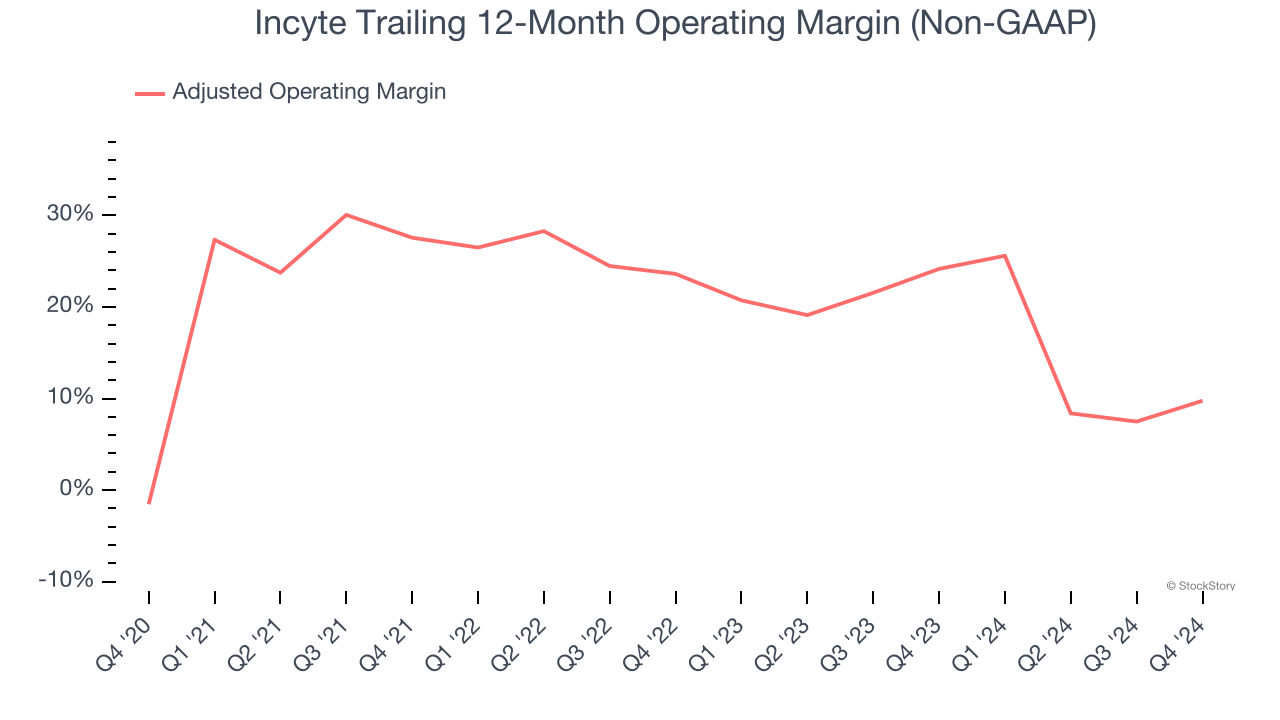

1. Shrinking Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Analyzing the trend in its profitability, Incyte’s adjusted operating margin decreased by 13.9 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 9.8%.

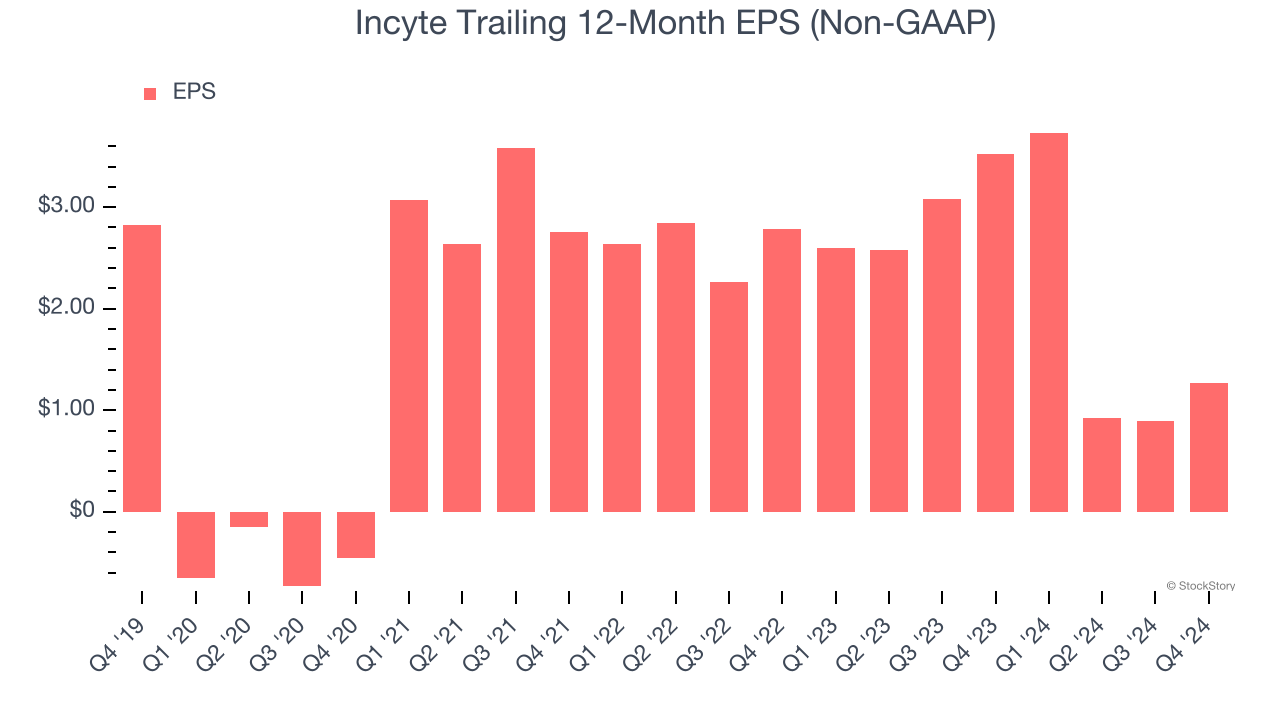

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Incyte, its EPS declined by 14.8% annually over the last five years while its revenue grew by 14.5%. This tells us the company became less profitable on a per-share basis as it expanded.

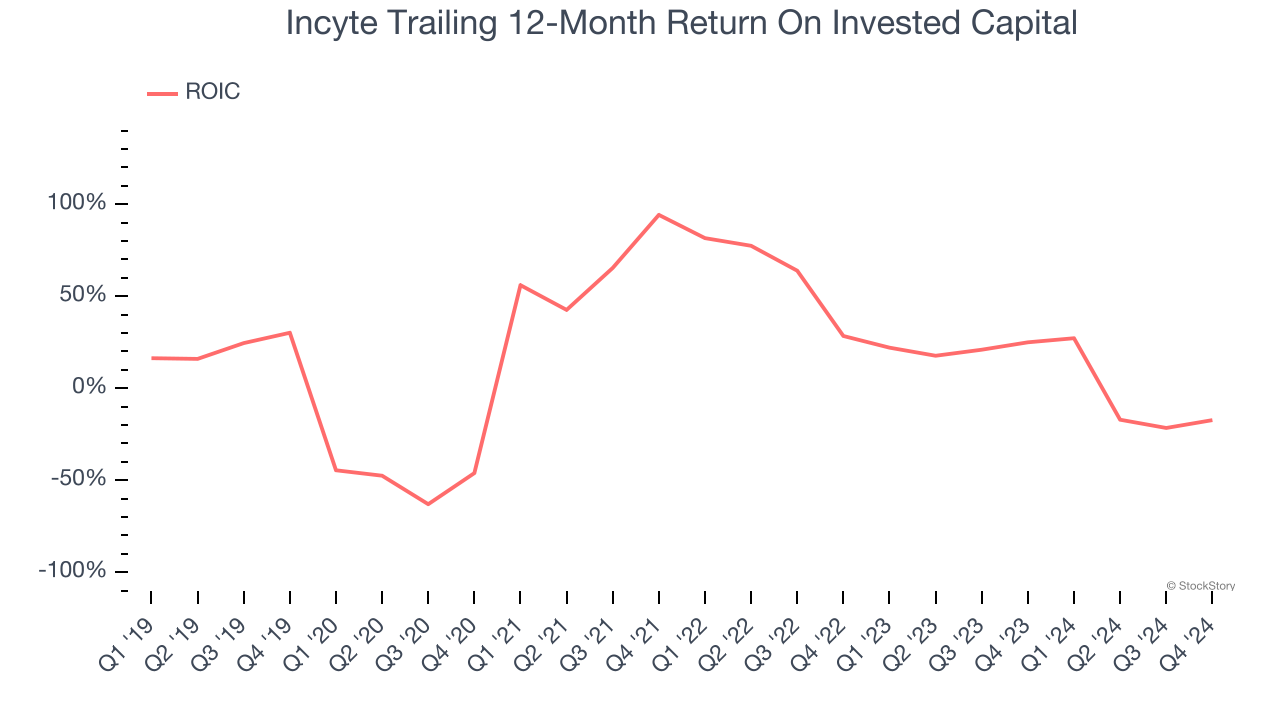

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Incyte’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Incyte isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 10.4× forward price-to-earnings (or $60.02 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Incyte

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.