While the broader market has struggled with the S&P 500 down 1.7% since October 2024, International Paper has surged ahead as its stock price has climbed by 8.2% to $53.24 per share. This run-up might have investors contemplating their next move.

Is now the time to buy International Paper, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We’re happy investors have made money, but we don't have much confidence in International Paper. Here are three reasons why you should be careful with IP and a stock we'd rather own.

Why Do We Think International Paper Will Underperform?

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. International Paper’s demand was weak over the last five years as its sales fell at a 3.6% annual rate. This was below our standards and is a sign of poor business quality.

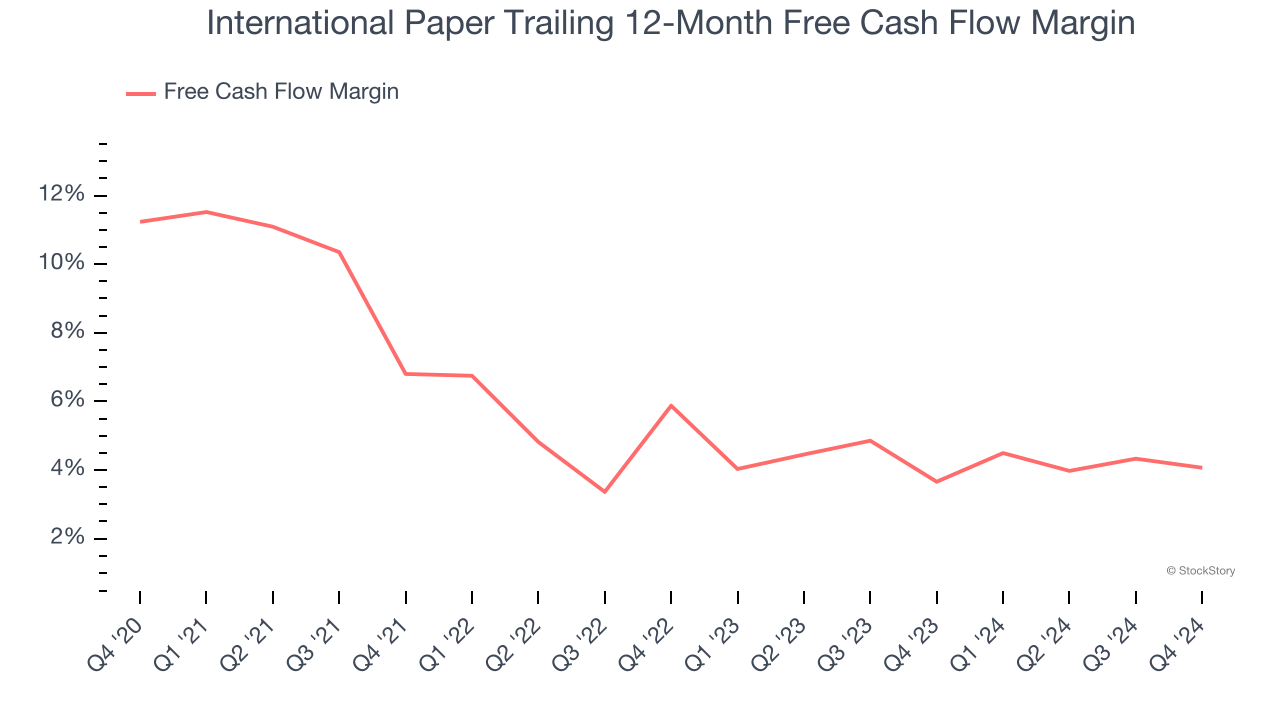

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, International Paper’s margin dropped by 7.2 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. International Paper’s free cash flow margin for the trailing 12 months was 4.1%.

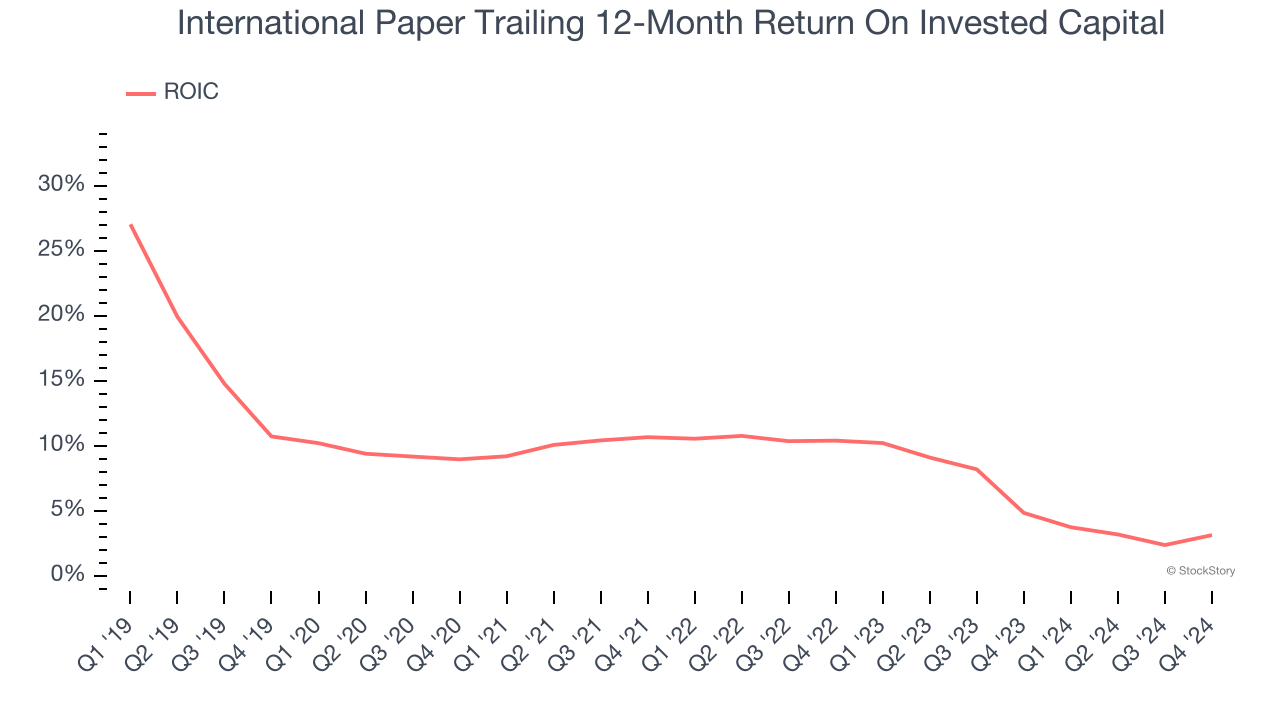

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, International Paper’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

International Paper doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 17.4× forward price-to-earnings (or $53.24 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of International Paper

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.