Lifestyle clothing conglomerate VF Corp (NYSE:VFC) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.76 billion. On the other hand, next quarter’s revenue guidance of $2.68 billion was less impressive, coming in 1.9% below analysts’ estimates. Its non-GAAP loss of $0.24 per share was 29.1% above analysts’ consensus estimates.

Is now the time to buy VF Corp? Find out by accessing our full research report, it’s free.

VF Corp (VFC) Q2 CY2025 Highlights:

- Revenue: $1.76 billion vs analyst estimates of $1.7 billion (flat year on year, 3.6% beat)

- Adjusted EPS: -$0.24 vs analyst estimates of -$0.34 (29.1% beat)

- Revenue Guidance for Q3 CY2025 is $2.68 billion at the midpoint, below analyst estimates of $2.73 billion

- Operating Margin: -4.9%, up from -7% in the same quarter last year

- Free Cash Flow was -$190.9 million compared to -$5.36 million in the same quarter last year

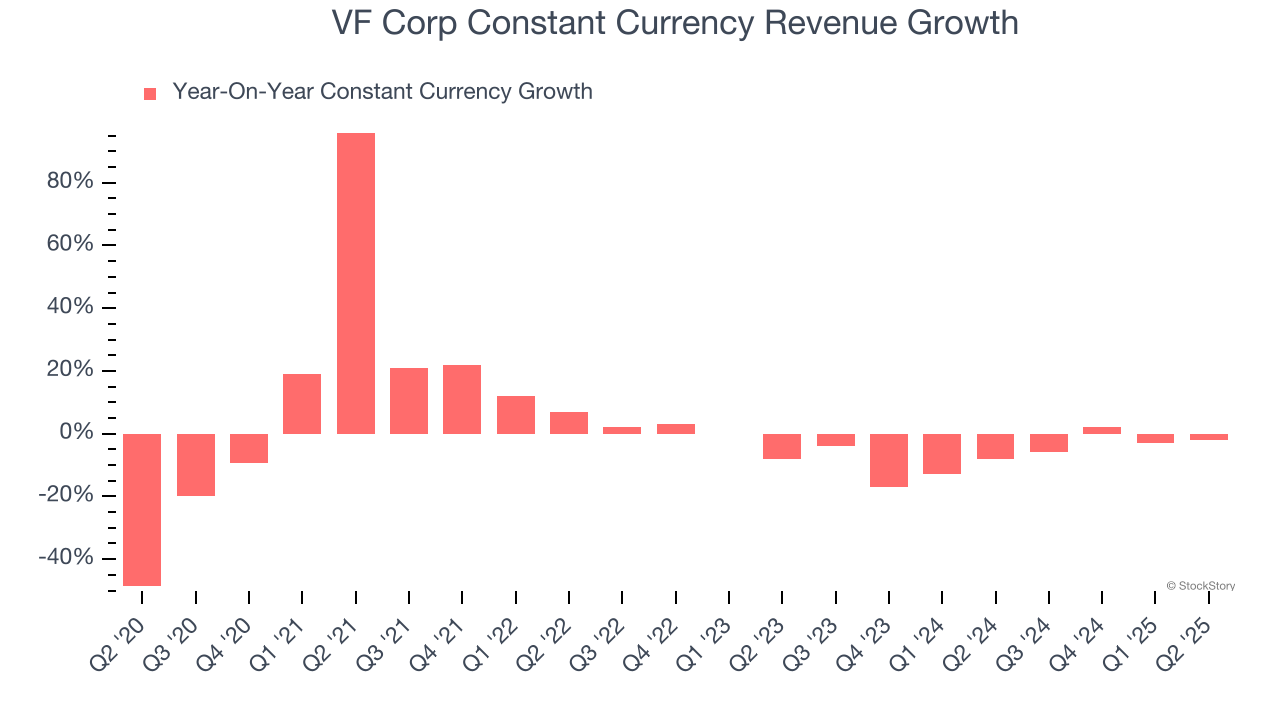

- Constant Currency Revenue fell 2% year on year (-8% in the same quarter last year)

- Market Capitalization: $4.83 billion

Company Overview

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

Revenue Growth

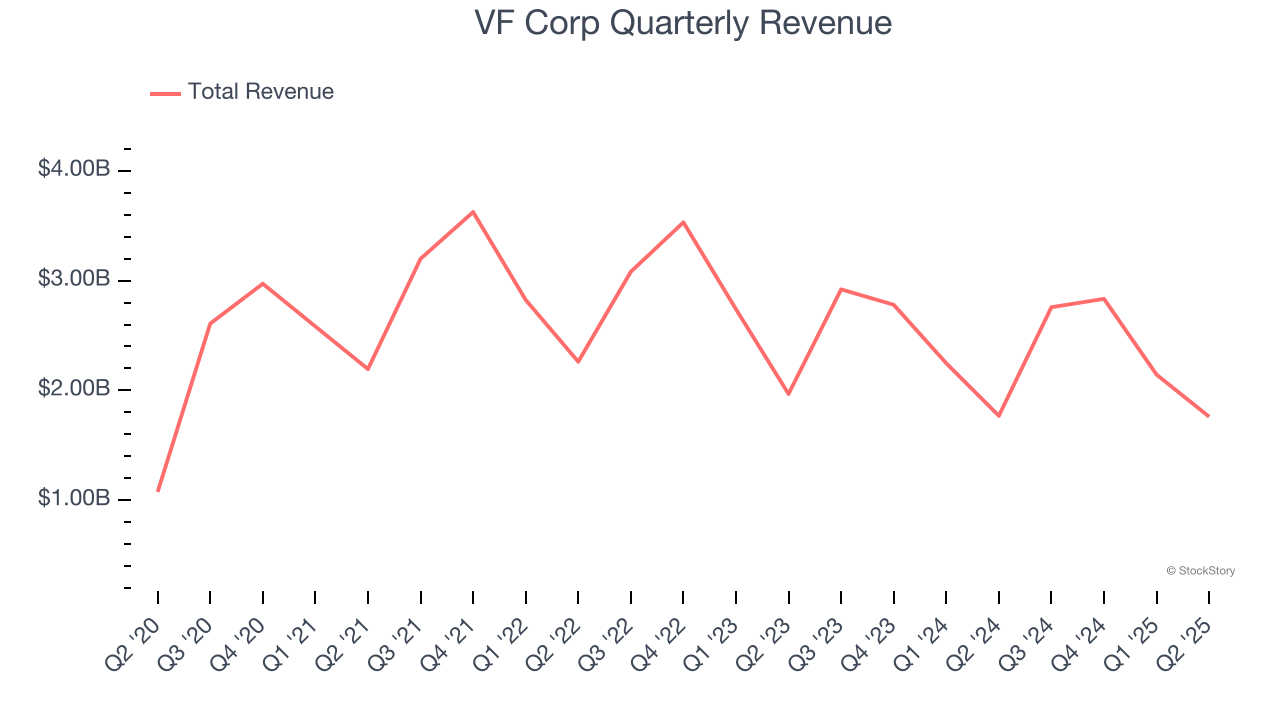

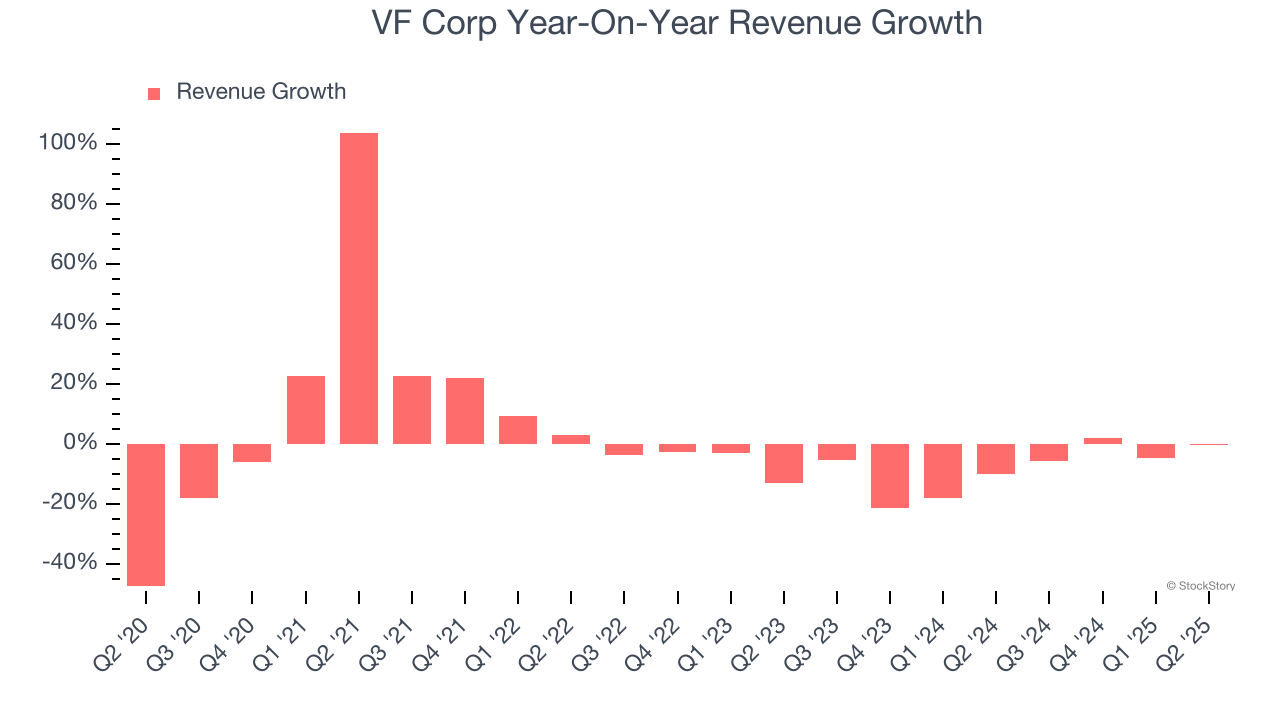

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, VF Corp struggled to consistently increase demand as its $9.50 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. VF Corp’s recent performance shows its demand remained suppressed as its revenue has declined by 8.4% annually over the last two years.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 6.4% year-on-year declines. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for VF Corp.

This quarter, VF Corp’s $1.76 billion of revenue was flat year on year but beat Wall Street’s estimates by 3.6%. Company management is currently guiding for a 3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

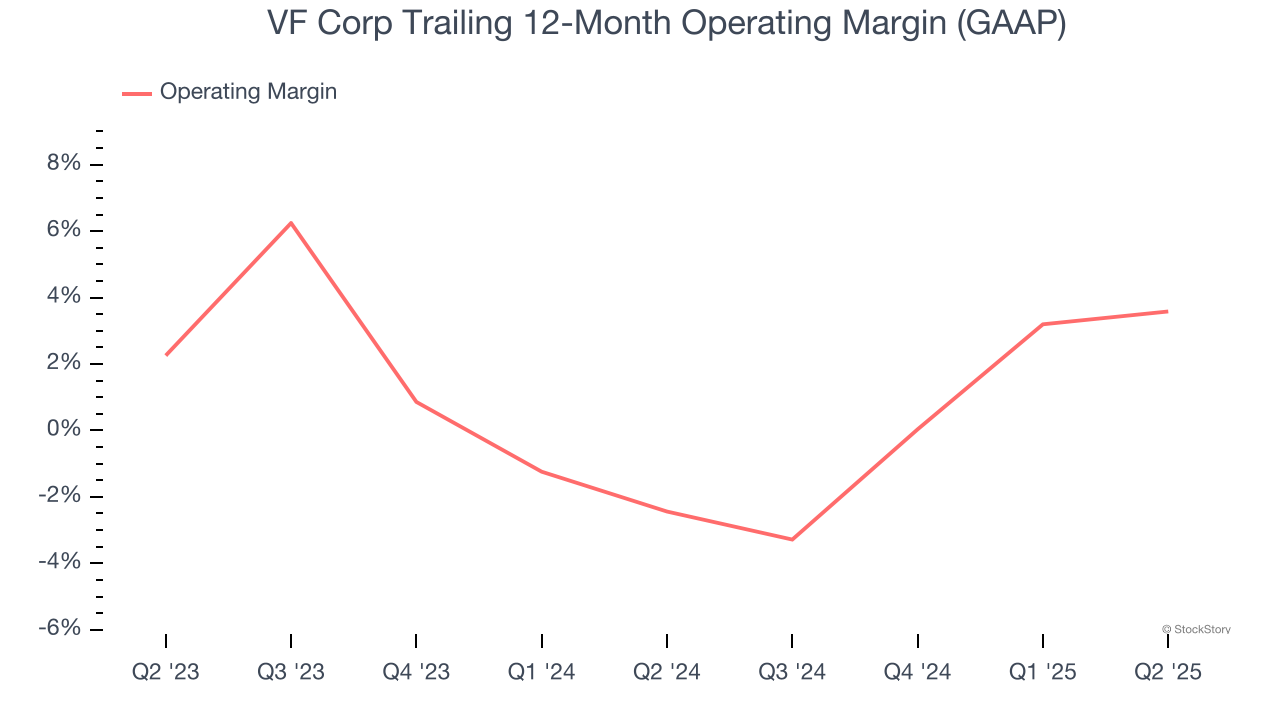

VF Corp’s operating margin has been trending up over the last 12 months, leading to break even profits over the last two years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for a consumer discretionary business.

In Q2, VF Corp generated an operating margin profit margin of negative 4.9%, up 2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

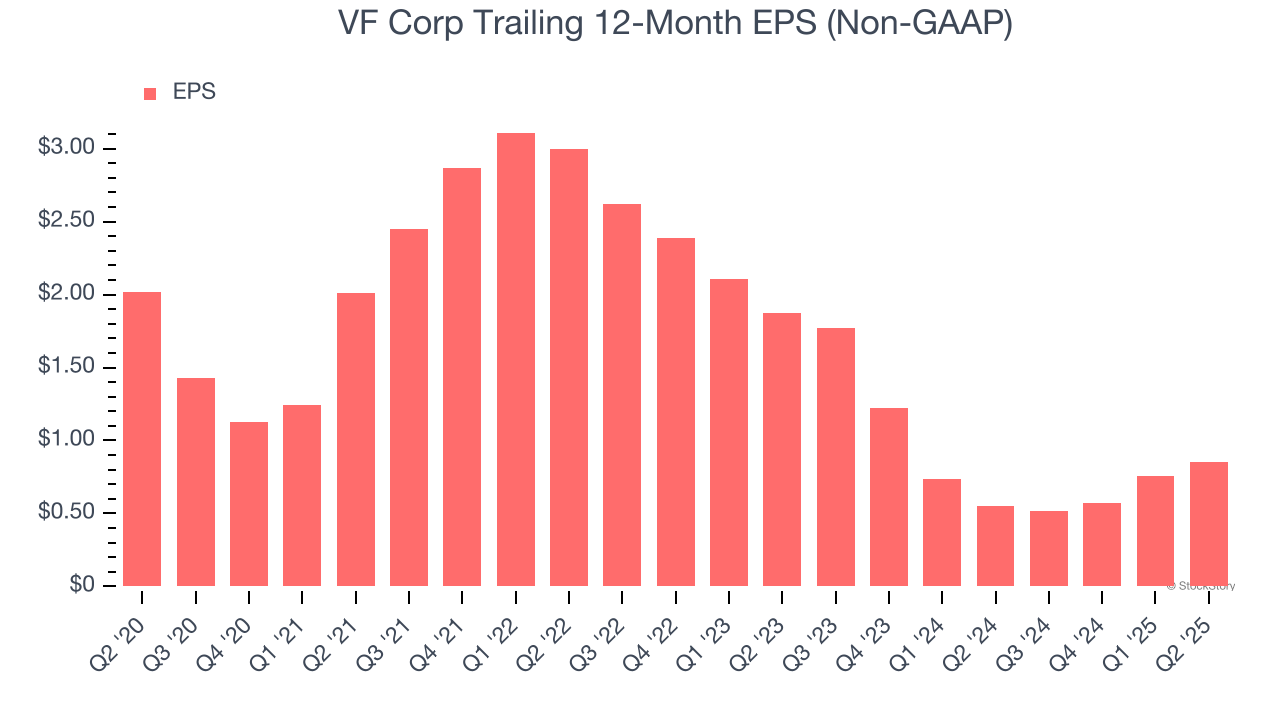

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for VF Corp, its EPS declined by 15.9% annually over the last five years while its revenue was flat. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q2, VF Corp reported EPS at negative $0.24, up from negative $0.33 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects VF Corp’s full-year EPS of $0.85 to grow 2.4%.

Key Takeaways from VF Corp’s Q2 Results

We enjoyed seeing VF Corp beat analysts’ EPS expectations this quarter. We were also glad its constant currency revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 20% to $14.91 immediately following the results.

VF Corp had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.