Articles from ExchangeRight

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce the appointment of Jason Roland as senior vice president of the Mid-Atlantic region. In his role, Roland will oversee client relationships and strategic development initiatives across Michigan, Indiana, Kentucky, Ohio, West Virginia, Virginia, Maryland, Delaware, and the District of Columbia.

By ExchangeRight · Via Business Wire · April 1, 2025

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce the addition of Will Powers as national sales director. Powers joins ExchangeRight to enhance and lead the company’s strategic relationships with broker-dealers, registered investment advisors (RIAs), and investment professionals nationwide, further supporting the firm’s dedication to providing secure capital, stable income, and strategic exits for its investors.

By ExchangeRight · Via Business Wire · March 27, 2025

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that demand for the company’s historically recession-resilient debt-free offerings has driven the full subscription of Net-Leased All-Cash 9 DST. The $24.78 million portfolio of net-leased real estate, backed by primarily investment-grade companies operating in necessity retail, provides investors with monthly distributions at a current rate of 5.20% covered 100% by in-place revenues from the offering. Net-Leased All-Cash 9 DST is a closed offering and is not accepting new investors.

By ExchangeRight · Via Business Wire · March 24, 2025

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is honored to now be serving more than 9,000 investors who trust the company to steward their wealth with investments that have consistently generated capital preservation and reliable returns, regardless of economic volatility since ExchangeRight’s inception in 2012. ExchangeRight has provided each of its investors with monthly distributions that have met or exceeded initial projections from inception to date across all 110 of the company’s past and current offerings. The ExchangeRight team is deeply grateful to the representatives and advisors who have trusted the company to deliver attractive returns and strategic exits for their clients. Past performance does not guarantee future results.

By ExchangeRight · Via Business Wire · March 10, 2025

ExchangeRight, a leading provider of diversified real estate DST and REIT investments, has announced that its Net-Leased Portfolio 67 DST was fully subscribed by investors seeking stable income and strategic exits through historically recession-resilient offerings. The $81.57 million offering features 371,430 square feet of real estate leased to national tenants successfully operating in necessity-based industries. The portfolio is structured to provide monthly distributions with a current annualized rate of 5.00%. Net-Leased Portfolio 67 DST is a closed offering and is not accepting new investors.

By ExchangeRight · Via Business Wire · March 5, 2025

ExchangeRight, one of the nation’s leading providers of diversified real estate REIT and DST investments, has announced that the Essential Income REIT’s tax-equivalent yield on 2024 distributions was 9.84% for its Class A shares, 10.47% for Class I shares, and 13.47–14.33% for its Class ER shares. The company’s calculations of tax-equivalent yield assume an investment that would have been made for the full year at the REIT’s current offering price, with a 37% federal income tax rate, an 8% state income tax rate, and a 3.8% Medicare surtax.

By ExchangeRight · Via Business Wire · February 25, 2025

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that demand for the company’s historically recession-resilient debt-free offerings has driven the full subscription of All-Cash 6 DST. The $23.26 million portfolio of net-leased real estate, backed by investment-grade companies operating in necessity retail, has been structured to provide investors with monthly distributions starting at an annualized rate of 5.20% covered 100% by in-place revenues from the offering. All-Cash 6 DST is a closed offering and is not accepting new investors.

By ExchangeRight · Via Business Wire · February 11, 2025

ExchangeRight has announced that for two consecutive quarters the Essential Income REIT was the only growth or stabilizing equity non-traded REIT (“NTR”) ranked in the highest grade for all three performance profile categories in Blue Vault’s non-traded REIT Industry Review for Q3 2024: “Operating Performance”, “Financing Outlook”, and “Cumulative MFFO Payout”.

By ExchangeRight · Via Business Wire · February 4, 2025

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that the Net Asset Value (“NAV”) per share of the Essential Income REIT has increased for four consecutive quarters, reaching $27.37 per share based in part on an independent real estate valuation of the REIT’s real estate by KPMG combined with its other assets and liabilities as of December 31, 2024.

By ExchangeRight · Via Business Wire · January 28, 2025

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that all of the company’s offerings continued to meet or exceed projections throughout 2024, extending an unbroken streak of never missing or reducing a distribution for any offering since ExchangeRight’s inception in 2012. Past performance does not guarantee future results.

By ExchangeRight · Via Business Wire · January 21, 2025

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, announced that it has completed its 24th full-cycle event with the $34 million sale of its Net-Leased Portfolio 6 DST to a net-leased REIT, providing investors with total return on sale including cash flow ranging from 160.02 to 163.62 percent while maintaining uninterrupted monthly distributions and meeting cash flow projections.

By ExchangeRight · Via Business Wire · April 14, 2022

Telos Capital, sister company of ExchangeRight, has brought its TCF9 Milford, MA Multifamily, LLC offering full cycle. The investment was in a 304-unit garden-style multifamily property in suburban Boston. Management was able to extract significant value-add for investors by separately metering utilities, performing unit upgrades and making improvements to common areas.

By ExchangeRight · Via Business Wire · April 5, 2022

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, announced that it has completed its 23rd full-cycle event with the sale of its Net-Leased Portfolio 16 DST, providing investors with total returns on sale including cash flow ranging from 134 to 143 percent while maintaining uninterrupted monthly distributions and meeting cash flow projections.

By ExchangeRight · Via Business Wire · March 23, 2022

ExchangeRight is pleased to share that the company and its partners provided over $23 million in charitable donations in 2021, bringing its life-to-date charitable giving to over $64 million in support of charities that have demonstrated success in meeting some of the deepest needs of a hurting world. In December, ExchangeRight launched its annual holiday charity impact campaign, raising over $650,000 from team members, investors, and industry partners in less than a month.

By ExchangeRight · Via Business Wire · February 17, 2022

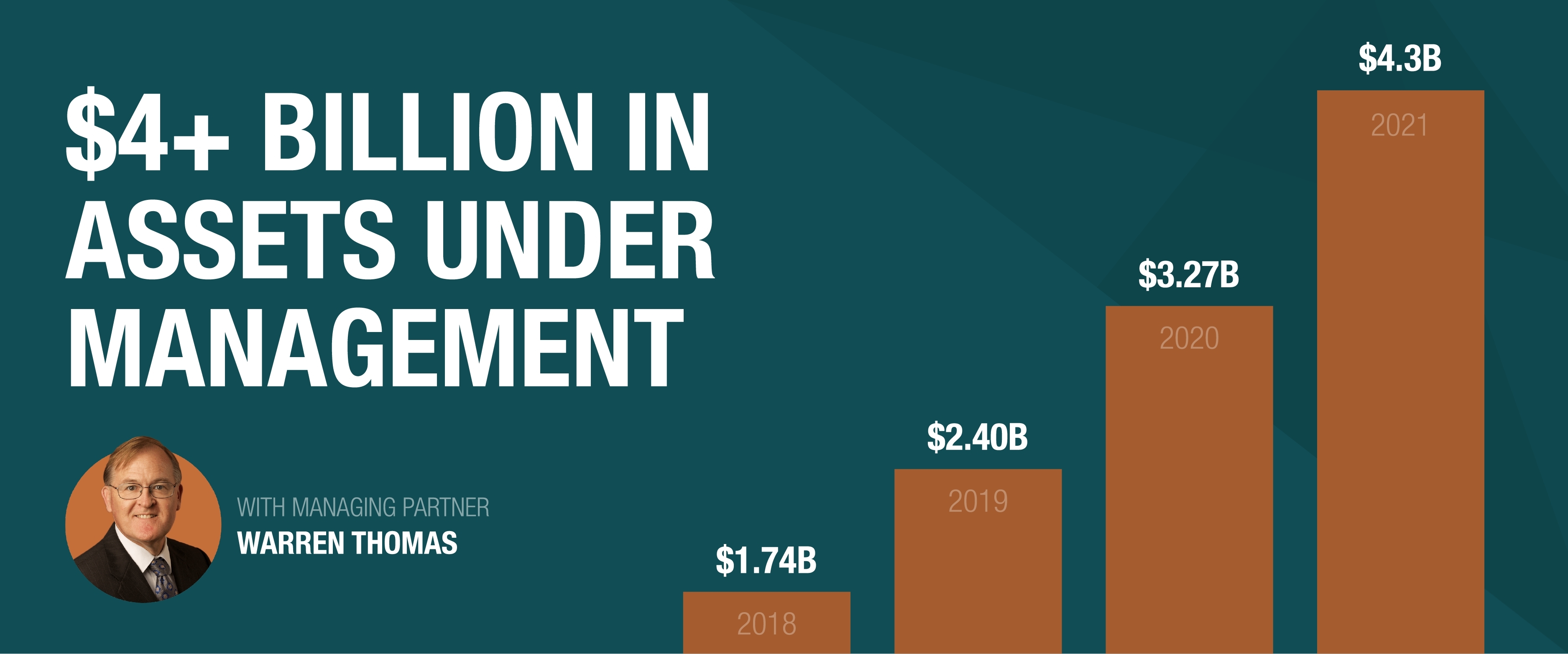

Investors entrusted over $673 million into ExchangeRight's net-leased and value-add DST, preferred equity, and REIT offerings in 2021, representing over 27% growth from 2020, the company’s best year on record. Over the past 5-year period, ExchangeRight’s net-leased DST offerings have produced average annual investor distributions of 6.70%, exceeding projections during that time frame.

By ExchangeRight · Via Business Wire · February 8, 2022

ExchangeRight has fully subscribed its $126 million Net-Leased Portfolio 49 DST offering, which is designed to generate investor distributions from approximately 600,000 square feet of net-leased property. The portfolio’s fully occupied 29 properties are net-leased to CVS Pharmacy, Dollar General, Dollar Tree, Hobby Lobby, Octapharma Plasma, Pick ‘n Save, Walgreens, and other essential operators. The properties are diversified across 16 states, including California, Georgia, Michigan, Illinois, and Ohio.

By ExchangeRight · Via Business Wire · January 20, 2022

ExchangeRight brought its $23 million Net-Leased Portfolio 5 DST full cycle on behalf of its investors. In connection with the closing, ExchangeRight provided the investors in the portfolio with the option to perform another 1031 exchange, receive cash, complete a tax-deferred 721 exchange, or a combination of these options.

By ExchangeRight · Via Business Wire · January 6, 2022

ExchangeRight has brought its sixth and final multifamily offering full cycle, generating total returns of 154.48% including return of capital to the DST and its investors. These returns represent a 14.35% annualized return on investors’ capital, which is over 2.4 times higher than the company’s original target of 5.96% annual returns. ExchangeRight provided uninterrupted monthly distributions at or in excess of the company’s projections throughout the offering’s hold period.

By ExchangeRight · Via Business Wire · December 13, 2021

ExchangeRight has brought another Net-Leased Portfolio DST full cycle in Q3 2021, generating annualized returns of 6.54% for investors who chose to cash out or complete a 1031 exchange with their proceeds. For investors who chose to complete a tax-deferred 721 exchange into the acquiring REIT, average annualized returns were equivalent to 7.99% based on an independent KPMG valuation of the acquiring portfolio. In conjunction with the closing, ExchangeRight provided the investors in each portfolio with the option to perform another 1031 exchange, receive cash, complete a tax-deferred 721 exchange, or any combination of these options.

By ExchangeRight · Via Business Wire · November 23, 2021

ExchangeRight and its affiliates have surpassed $4 billion in assets under management with the full subscription of ExchangeRight’s 50th net-leased portfolio, maintaining 100% rent collection across all 975+ of its net-leased properties under management. The company has provided uninterrupted investor distributions meeting or exceeding projected cash flow targets across all offerings since ExchangeRight’s founding. All full-cycle events completed by the company have outperformed original return projections.

By ExchangeRight · Via Business Wire · November 16, 2021

ExchangeRight is pleased to announce the addition of Fletcher Galloway to its Broker-Dealer & RIA Relations team. As senior vice president and external wholesaler, Galloway will serve representatives and advisors in the Great Lakes and North Eastern regions, with a focus on ExchangeRight’s REIT platform.

By ExchangeRight · Via Business Wire · November 3, 2021

ExchangeRight's sister company Telos Capital, a private equity real estate investment company that focuses on value-add and development real estate investments across all asset classes and sectors, has brought its TCF2 Stella Mare investment full cycle on behalf of its investors. The property generated total returns including distributions during the hold period of over 168% of originally invested equity, with a net investor annual internal rate of return of over 11% annualized.

By ExchangeRight · Via Business Wire · October 28, 2021

The Institute for Portfolio Alternatives (“IPA”) has honored David Fisher, a managing partner of ExchangeRight, with its Outstanding Service Award, highlighting his work as a staunch advocate for Section 1031, real estate investors, the securitized real estate industry, and the IPA.

By ExchangeRight · Via Business Wire · October 19, 2021

ExchangeRight has fully subscribed its $86.38 million Net-Leased Portfolio 48 DST offering, which is designed to generate investor distributions from over 287,000 square feet of net-leased property. The necessity-based retail, banking, and healthcare tenants selected for the offering satisfy ExchangeRight’s disciplined acquisition criteria, which targets net-leased properties backed primarily by investment-grade tenants operating essential businesses.

By ExchangeRight · Via Business Wire · October 14, 2021

ExchangeRight's sister company Telos Capital, a private equity real estate investment company that focuses on value-add real estate investments across all asset classes and sectors, has brought its TCF12 Columbus Industrial, LLC investment full cycle on behalf of its investors. The investment generated total returns of approximately 181% of originally invested equity and a net investor annual internal rate of return of 21.1% annualized, over 37% higher than its original base-case projections.

By ExchangeRight · Via Business Wire · September 2, 2021

ExchangeRight has fully subscribed its $58.85 million Net-Leased Portfolio 47 DST offering, which is designed to preserve investor capital, generate stable income, and provide access to ExchangeRight's aggregated exit strategy. The tenants selected for the offering satisfy the company’s disciplined acquisition criteria, which target net-leased properties backed primarily by investment-grade tenants operating essential businesses. The company focuses on portfolios with tenants that provide goods and services in necessity-based retail and healthcare, in order to serve investor needs over the long-term, even through economic cycles.

By ExchangeRight · Via Business Wire · August 19, 2021

ExchangeRight has fully subscribed its $81.11 million Net-Leased Portfolio 46 DST offering. The tenants selected for the offering satisfy the criteria for the company’s acquisition strategy, which targets properties occupied by national companies with strong financials and operations in necessity-based retail or healthcare services.

By ExchangeRight · Via Business Wire · July 8, 2021

ExchangeRight, a vertically integrated real estate company that has met or exceeded investor cash flow targets on all of its offerings since inception, has fully subscribed its $68.15 million Net-Leased Portfolio 45 DST offering. The tenants selected for the offering meet ExchangeRight’s strict acquisition criteria focused on national companies with strong balance sheets that provide necessity-based goods and services.

By ExchangeRight · Via Business Wire · June 22, 2021

ExchangeRight has fully subscribed its all-equity $23.77 million Net-Leased Portfolio 44 DST offering. The tenants included in the portfolio follow ExchangeRight’s strict acquisition criteria focused on national companies that provide necessity-based essential retail and medical services. The portfolio's five single-tenant-net-leased properties are 100% occupied by Dollar General, Natural Grocers, and Walgreens. All of the tenants in the offering remained open and operating to serve the public throughout the COVID-19 crisis.

By ExchangeRight · Via Business Wire · June 10, 2021

ExchangeRight has fully subscribed its $96.85 million Net-Leased Portfolio 43 DST offering leased exclusively to tenants operating in seven essential industries serving 16 markets across the nation. The offering’s properties are net-leased to nine tenants, including Whole Foods Market, Walgreens, Lowe’s, and Tractor Supply, each of which satisfy ExchangeRight’s strict acquisition strategy focused on investment-grade-rated national companies.

By ExchangeRight · Via Business Wire · April 15, 2021

ExchangeRight has recently brought two additional Net-Leased Portfolio DSTs full cycle in Q1 2021, generating annual returns ranging from 6.77-7.73% for investors who chose to cash out or complete a 1031 exchange with their proceeds. Annual returns were the equivalent of 8.31-9.16% for investors who chose to complete a tax-deferred 721 exchange into the acquiring REIT, based on an independent KPMG valuation of the acquiring portfolio. ExchangeRight provided the investors in each portfolio with the option to perform another 1031 exchange, receive cash, complete a tax-deferred 721 exchange, or any combination of these options.

By ExchangeRight · Via Business Wire · April 13, 2021