Articles from Ramsey Solutions

Nashville, Tennessee, April 01, 2025 (GLOBE NEWSWIRE) -- In honor of National Financial Literacy Month, Ramsey Education, a division of Ramsey Solutions, is recognizing the dedicated work of teachers nationwide with the 2025 Teacher Appreciation Giveaway. This initiative offers an exciting opportunity for pre-K through 12th-grade educators. One lucky teacher will win a $5,000 vacation of their choice, while two additional winners will each receive $3,000 toward a vacation of their choice. Teachers can enter the giveaway from now until April 30, 2025, at ramseysolutions.com/teacher.

By Ramsey Solutions · Via GlobeNewswire · April 1, 2025

The road map that takes the guesswork out of growing your business

By Ramsey Solutions · Via GlobeNewswire · February 17, 2025

New State Of Personal Finance Report finds young families face challenges buying a home and starting a family

By Ramsey Solutions · Via GlobeNewswire · February 3, 2025

New Ramsey Solutions Research Shows Millennials Are Most Concerned

By Ramsey Solutions · Via GlobeNewswire · October 21, 2024

New Ramsey Solutions Research Shows Gaps in Retirement and Savings

By Ramsey Solutions · Via GlobeNewswire · September 16, 2024

Expanded Edition Features Updated Statistics and Advice on New Topics

By Ramsey Solutions · Via GlobeNewswire · May 14, 2024

Find The Work You're Wired To Do Releases Today

By Ramsey Solutions · Via GlobeNewswire · May 7, 2024

Nashville, Tenn., April 01, 2024 (GLOBE NEWSWIRE) -- Ramsey Solutions is honoring teachers for National Financial Literacy Month in April. Ramsey Education, a leader in the personal finance education space, is sponsoring the Ramsey Teacher Appreciation Giveaway for pre-K through 12th-grade teachers. One teacher will win a $5,000 vacation of their choice, and two additional teachers will each win a $3,000 vacation of their choice. Teachers can register now through April 30, 2024, at ramseysolutions.com/teacher. “Honoring and celebrating teachers is a big deal to us,” said Jim King, the executive vice president of Ramsey Education. “For more than 20 years, we’ve worked closely with educators, and we see how hard they work to improve the lives of their students. With this small recognition through the Teacher Appreciation Giveaway, I hope they feel empowered to continue the work they do in and out of the classroom.”

By Ramsey Solutions · Via GlobeNewswire · April 1, 2024

Nashville, Tenn., Jan. 30, 2024 (GLOBE NEWSWIRE) -- George Kamel, co-host of “The Ramsey Show” is now a bestselling author. His first book, “Breaking Free From Broke” topped the bestseller list this week. In it, Kamel draws on his lived experiences to reveal the myths and lies we’ve come to believe about personal finance. “I had one goal with “Breaking Free From Broke:” write a book about money that doesn’t feel like a root canal,” said Kamel. “Whether you’re 25 or 65, it’s everything you never learned about money but wish you did. It’s an easy read filled with humor, research, empathy, and hope. It’s very much possible to build wealth in America today, but it starts with learning how to rise above the system keeping you broke.” Following a proven plan, Kamel went from broke to a millionaire in under 10 years. Pairing pop culture with humor, wit and well-researched data, Kamel breaks down what’s holding Americans back when it comes to:

By Ramsey Solutions · Via GlobeNewswire · January 30, 2024

Nashville, Tennessee, Jan. 22, 2024 (GLOBE NEWSWIRE) -- SmartDollar, the employee financial wellness program developed by personal finance expert Dave Ramsey, proudly announces its users have achieved $1 billion in financial turnaround — the amount of debt current SmartDollar users have paid off and how much money they've put into savings, since starting the program.

By Ramsey Solutions · Via GlobeNewswire · January 22, 2024

Nashville, Tenn., Jan. 16, 2024 (GLOBE NEWSWIRE) -- In his first book, personal finance expert George Kamel exposes the money traps stealing Americans’ margin, freedom and joy. “Breaking Free From Broke,” published by Ramsey Solutions, releases today. In it, Kamel draws on his lived experiences to reveal the myths and lies we’ve come to believe about personal finance. “America is the land of the free and home of the broke,” said Kamel. “Millions of Americans aren’t where they want to be financially. They weren’t taught this stuff, and now it feels like they’ll never get ahead. I get it. I still remember feeling stressed about money and hopeless about the future. Even though it wasn’t my fault, it was my responsibility to get myself out of this money mess. Now I want to empower others to do the same.” Following a proven plan, Kamel went from broke to a millionaire in under 10 years. Pairing pop culture with humor, wit and well-researched data, Kamel breaks down what’s holding Americans back when it comes to:

By Ramsey Solutions · Via GlobeNewswire · January 16, 2024

Viewers Can Also Enter a $1,000 Giveaway

By Ramsey Solutions · Via GlobeNewswire · January 8, 2024

Nashville, Tenn., Nov. 07, 2023 (GLOBE NEWSWIRE) -- In a culture of same-day deliveries and on-demand streaming, it’s easy for families to adjust to an instant gratification lifestyle, but does the convenience of impulse spending bring lasting joy? In her debut children’s book, bestselling author and personal finance expert Rachel Cruze shares the importance of contentment in “I’m Glad for What I Have.”

By Ramsey Solutions · Via GlobeNewswire · November 7, 2023

Nashville, Tennessee, Nov. 06, 2023 (GLOBE NEWSWIRE) -- The numbers don’t lie: America’s military heroes are struggling with money. A recent survey conducted by Wounded Warrior Project finds 6 in 10 veterans did not have enough money to make ends meet at some point in the past year. The survey also finds the rising cost of goods is the top-rated source of financial strain.

By Ramsey Solutions · Via GlobeNewswire · November 6, 2023

NASHVILLE, Tenn., Sept. 07, 2023 (GLOBE NEWSWIRE) -- More than half of all student loan borrowers say they don’t feel financially ready for payments on their loans to resume in October. And while interest on these loans begins accruing again in September, only 42% say they know what the new monthly payments on their loans will be.1

By Ramsey Solutions · Via GlobeNewswire · September 7, 2023

Nashville, Tenn., Aug. 01, 2023 (GLOBE NEWSWIRE) -- According to the National Alliance on Mental Illness, anxiety disorders are the most common mental illness in the United States, affecting more than 40 million adults, or nearly 20% of the population. Whether it shows up in the mundane tasks of life or as a debilitating panic attack, anxiety sufferers continue to search for actionable ways to manage loneliness, exhaustion, angst and stress.

By Ramsey Solutions · Via GlobeNewswire · August 1, 2023

Nashville, Tenn., May 24, 2023 (GLOBE NEWSWIRE) -- Ramsey Solutions is hosting EntreLeadership Summit 2023 at the Gaylord Opryland Resort in Nashville, Tennessee. The event, available for livestream, features world-class business and thought leaders who will challenge, motivate and inspire attendees in their lives and businesses. EntreLeadership Summit takes place May 31st through June 2nd, 2023. EntreLeadership Summit is for business owners and leaders with a heart for investing in themselves and their teams. This year’s speakers include Ramsey Solutions’ CEO Dave Ramsey, bestselling author Malcolm Gladwell, clinical psychologist Dr. Jordan Peterson, Food Network celebrity chef and restaurateur Maneet Chauhan and more. “World-class leadership is becoming more important because that’s who people want to follow,” said Dave Ramsey. “Something happens when you get thousands of powerhouse leaders in one room. After leaving Summit, you’ll be ready to hire and retain top talent, lead with confidence, and strengthen your company culture.”

By Ramsey Solutions · Via GlobeNewswire · May 24, 2023

Research Done by Ramsey Solutions Finds Small Businesses Remain Resilient Despite Massive Economic Challenges

By Ramsey Solutions · Via GlobeNewswire · May 22, 2023

Nashville, Tenn., May 08, 2023 (GLOBE NEWSWIRE) -- From negative net worth to millionaire, George Kamel, co-host of “The Ramsey Show” on the Ramsey Network, has successfully navigated the money minefield. On the new George Kamel YouTube channel, he’ll tackle the tough topic of money with humor and wit, helping others win with money while exposing a system designed to keep Americans broke. "There's so much anxiety and frustration around money,” Kamel said. “I’m so pumped about this channel because we’re going to show people personal finance doesn’t need to be complicated, and we’re going to have a lot of fun doing it.” With new episodes every Monday, Wednesday and Friday, Kamel will help viewers how to live a life without debt, build wealth the right way, and avoid trends and traps that could hurt their financial future. “I want people to learn something new, laugh along the way, and leave more hopeful and confident with their money decisions and goals,” Kamel said. “There are so many sketchy companies and people on social media sharing bad advice that’s tripping people up. I want to empower people to break free from a toxic money culture, so that they can live a life with more margin, options, peace and freedom. That’s my hope for everyone watching this channel.”

By Ramsey Solutions · Via GlobeNewswire · May 8, 2023

“America’s Labor Crisis” Featuring Mike Rowe and Dave Ramsey

By Ramsey Solutions · Via GlobeNewswire · May 2, 2023

Nashville, Tenn., April 17, 2023 (GLOBE NEWSWIRE) -- Ramsey Solutions is celebrating 10 years of honoring teachers with a teacher appreciation giveaway during April, which is National Financial Literacy Month. This year, the Army National Guard is presenting the Ramsey Teacher Appreciation Giveaway for pre-K through 12th-grade teachers. One teacher will win a $5,000 vacation of their choice, and two additional teachers will each win a $3,000 vacation of their choice. Educators can register now through April 30 at ramseysolutions.com/teacher.

By Ramsey Solutions · Via GlobeNewswire · April 17, 2023

NASHVILLE, Tenn., Feb. 27, 2023 (GLOBE NEWSWIRE) -- EveryDollar, the zero-based budgeting app by Ramsey Solutions, with over 10 million budgeters, has released two new premium features: financial roadmap and paycheck planning. The financial roadmap feature allows budgeters to visualize their long-term goals — from saving their first $1,000 all the way to becoming a millionaire.

By Ramsey Solutions · Via GlobeNewswire · February 27, 2023

Nashville, Tenn., April 03, 2023 (GLOBE NEWSWIRE) -- Graduating from high school is often a rite of passage into adulthood for young Americans. But figuring out how to pay for college, afford rent and groceries each month, and save for the future can be overwhelming. The Financial Literacy Crisis in America 2023 report by Ramsey Education found Americans feel high school left them unprepared for handling money. And while the focus on personal finance education has been increasing nationwide in recent years, for many Americans in the workforce, the lack of that education has had a lasting impacts. “Money is something we all should know how to handle going into the real world, yet it’s clear many people are left in the dark,” said Kristina Ellis, college finance expert and Ramsey Solutions Personality. “Learning solid money principles early — such as how to budget, save, and spend wisely — is crucial for success in your adult life.” Three in 4 Americans said that after high school, they “often” or “sometimes” felt stress because of money. But adults who took a personal finance class in high school were five times more likely to say they graduated fully prepared for handling money in the real world. “This last year has been so hard for people financially, and I feel for them,” Ellis said. “My hope is more states will require this education for graduation so in times of inflation or when their budgets feel tighter, more Americans are ready to handle their money and succeed.” Other findings from the report include:

By Ramsey Solutions · Via GlobeNewswire · April 3, 2023

Popular Business Show Will Now Be Caller-Driven

By Ramsey Solutions · Via GlobeNewswire · February 13, 2023

Nashville, Tenn., March 02, 2023 (GLOBE NEWSWIRE) -- The year 2022 was a roller coaster for many Americans. Rising grocery prices, increased gas expenses, general inflation, and worries of an economic recession caused Americans to struggle financially, according to The State of Personal Finance: Trends for 2023 Report published by Ramsey Solutions. Over the last two years, Americans who reported their finances as “in crisis” or “struggling” increased by 45%. While budgets seemed to have gotten tighter, only 4 in 10 Americans felt optimism about their financial future. One of the biggest challenges reported by Americans was the rising cost of daily expenses. The number of people who reported difficulty paying bills increased by 42% over the last two years, with an increase of 37% in difficulty providing food for their family. “My personal finances are slightly above average,” said a 33-year-old survey participant. “The rising cost of inflation in America, though, has significantly impacted my household's monthly budget. Leisure activities aren't a priority currently.” Though down from their peaks in quarter two of 2022, daily worry and lost sleep because of personal finances are still impacting millions of people as we head into 2023. People with debt worry more than those without debt (64% and 45%, respectively), the study finds. The study also found 71% of people making less than $50,000 a year for their household income reported they worry daily. And 37% of people making over $100,000 a year for their household income worry every single day about their finances. “This report shows there’s no golden number for a yearly salary,” said Jade Warshaw, Ramsey Personality and debt elimination expert. “How much money you make isn’t the issue. It’s how you manage the money you have. Your income is your biggest wealth-building tool, and if you’re giving it away in debt payments every month, you’ll never get ahead. Now is the time to make a plan for your money so you can have a better financial foundation months and years from now.” Other key findings:

By Ramsey Solutions · Via GlobeNewswire · March 2, 2023

NASHVILLE, Tenn., Jan. 09, 2023 (GLOBE NEWSWIRE) -- The newest edition of The State of Personal Finance by Ramsey Solutions revealed a possible correlation between worry and experience when it comes to money. The report found that 71% of Gen Z compared to 42% of baby boomers are more concerned about their finances. More so, 25% of Americans said they are relying on credit cards more than normal to cover their bills, according to the report.

By Ramsey Solutions · Via GlobeNewswire · January 9, 2023

Attendees Will Learn How to Navigate Tough Economic Times and Find Margin in Their Budgets

By Ramsey Solutions · Via GlobeNewswire · December 19, 2022

New Content, New Price, New Ways to Win With Money

By Ramsey Solutions · Via GlobeNewswire · December 6, 2022

Nashville, Tenn., Nov. 15, 2022 (GLOBE NEWSWIRE) -- As inflation continues to rise in the third quarter of 2022, Americans are tightening their grip on their budgets. According to the latest edition of The State of Personal Finance 2022 by Ramsey Solutions, over 100 million Americans (37%) say they’re either struggling or in crisis with their finances. Debt is also on the rise, with 1 in 5 Americans saying they’ve taken on more debt since June.

By Ramsey Solutions · Via GlobeNewswire · November 15, 2022

Curriculum on Sale Through the End of the Year

By Ramsey Solutions · Via GlobeNewswire · November 1, 2022

Nashville, Tenn., Oct. 24, 2022 (GLOBE NEWSWIRE) -- Ramsey Solutions, a company that empowers people to win with their money, announced today the launch of Gazelle, a debit card and spending account that helps customers stay focused on their money goals. The app aligns with the debt-free principles Ramsey is known for, with banking services by Pathward, N.A., Member FDIC and embedded financial technology from Netspend.

By Ramsey Solutions · Via GlobeNewswire · October 24, 2022

Hosts Rachel Cruze and George Kamel Talk Money, Pop Culture, Trends and More

By Ramsey Solutions · Via GlobeNewswire · October 3, 2022

Rising inflation is impacting nearly every American in the early start of 2022. But according to Ramsey Solutions’ Q1 State of Personal Finance study, 85% of those who use a monthly budget believe it helped control their impulse spending. The study reveals 8 in 10 Americans are struggling with their day-to-day finances due to rising costs.

By Ramsey Solutions · Via Business Wire · May 23, 2022

Ramsey Solutions’ documentary “Borrowed Future” has been recognized as the Best Video Documentary in the Longform category of the 2022 Annual Webby Awards. Known as the “best of the Internet,” the Webby Awards are presented by the International Academy of Digital Arts and Sciences (IADAS), the leading international awards organization honoring excellence on the Internet.

By Ramsey Solutions · Via Business Wire · May 9, 2022

It’s no secret that the pace of life has made us exhausted. National bestselling author and mental health and wellness expert Dr. John Delony reminds readers there’s a better, healthier way to live in his new book, “Own Your Past, Change Your Future,” published by Ramsey Press (ISBN: 9781942121626).

By Ramsey Solutions · Via Business Wire · April 19, 2022

For the ninth year, Ramsey Solutions is honoring teachers with a Teacher Appreciation Giveaway during National Financial Literacy Month. Thanks to the sponsorship of Borrowed Future, LLC, pre-K through 12th grade teachers can register from April 1 through April 30 for a chance to win a cash prize at ramseysolutions.com/teacher.

By Ramsey Solutions · Via Business Wire · April 4, 2022

The struggle is real. The pandemic, the rising cost of living in an unstable economy, and daily images of war on our televisions have taken a toll on many Americans. One poll conducted by Suffolk University and USA Today showed that most registered voters believe we are in a full-blown mental health crisis, USA Today reported in January 2022.

By Ramsey Solutions · Via Business Wire · March 29, 2022

Despite a downward trend in the overall assessment of Americans and personal finances in 2021, 80 percent said they are hopeful about their financial situation for 2022. According to The State of Personal Finance 2021 Annual Report published by Ramsey Solutions, optimism is consistent for those who are in debt versus those who are debt-free. But those in debt were nearly twice as likely to say their finances were struggling or in crisis.

By Ramsey Solutions · Via Business Wire · February 28, 2022

Marriage isn’t for the faint of heart. Whether it’s lack of communication, financial stress or a difference in parenting, marital strain is inevitable. But Ramsey Solutions wants to equip couples with the tools to build a stronger relationship with the Money & Marriage livestream: Valentine’s Day Edition on Friday, Feb. 11, at 7 p.m. CST.

By Ramsey Solutions · Via Business Wire · February 9, 2022

“Own Your Past, Change Your Future,” written by national bestselling author and mental health expert Dr. John Delony, is now available for presale. Published by Ramsey Press, “Own Your Past, Change Your Future” (ISBN: 9781942121626) retails for $24.99.

By Ramsey Solutions · Via Business Wire · February 7, 2022

Becoming a millionaire can seem like a distant dream, but tens of thousands of people have accomplished it by following the Ramsey Baby Steps. Their inspirational stories are out today in Dave Ramsey’s latest book, “Baby Steps Millionaires,” published by Ramsey Press (ISBN: 9781942121596).

By Ramsey Solutions · Via Business Wire · January 11, 2022

Retirement is the number one long-term savings goal among Americans, but according to Ramsey Solutions’ State of Personal Finance study, more than half (56%) feel behind on investing. And 42% aren’t saving for retirement at all. It’s a startling statistic to hear as the new year begins, but Ramsey Solutions is hosting a free livestream to give viewers a proven plan for building wealth. Tune into Building Wealth in 2022 live on Thursday, Jan. 13, at 7 p.m. CST.

By Ramsey Solutions · Via Business Wire · January 10, 2022

As Americans head into the holiday season, they are met with an inflation rate of 6.2%, up five percentage points from one year ago. Ramsey Solutions’ Q3 State of Personal Finance study reveals that one in five Americans’ day-to-day finances are being significantly impacted by inflation; however, 25% of Americans are planning to spend more this holiday season than they did last year.

By Ramsey Solutions · Via Business Wire · November 15, 2021

To educate and empower the next generation about alternatives to student loans, Ramsey Solutions is offering every teacher in the U.S. free access to the documentary “Borrowed Future: How Student Loans Are Killing the American Dream,” produced by Dave Ramsey. Teachers can go to borrowedfuture.com for more information.

By Ramsey Solutions · Via Business Wire · October 14, 2021

Bestselling author and personal development expert Christy Wright offers a new perspective on life balance with step-by-step advice on how to create it in her new book, “Take Back Your Time: The Guilt-Free Guide to Life Balance.” Published by Ramsey Press, “Take Back Your Time” (ISBN: 9781942121565) releases September 14, 2021, and retails for $19.99.

By Ramsey Solutions · Via Business Wire · September 14, 2021

Nearly half a million high school students across the U.S. will be learning money principles that will stay with them for a lifetime as they go back to school this fall. They’ll be taking Foundations In Personal Finance: High School Edition, the course from Ramsey Solutions trusted by educators for more than 10 years. Foundations teachers say that today’s students are curious about building wealth through investments, and test scores prove that Foundations makes complex money topics like investing easy to understand.

By Ramsey Solutions · Via Business Wire · August 16, 2021

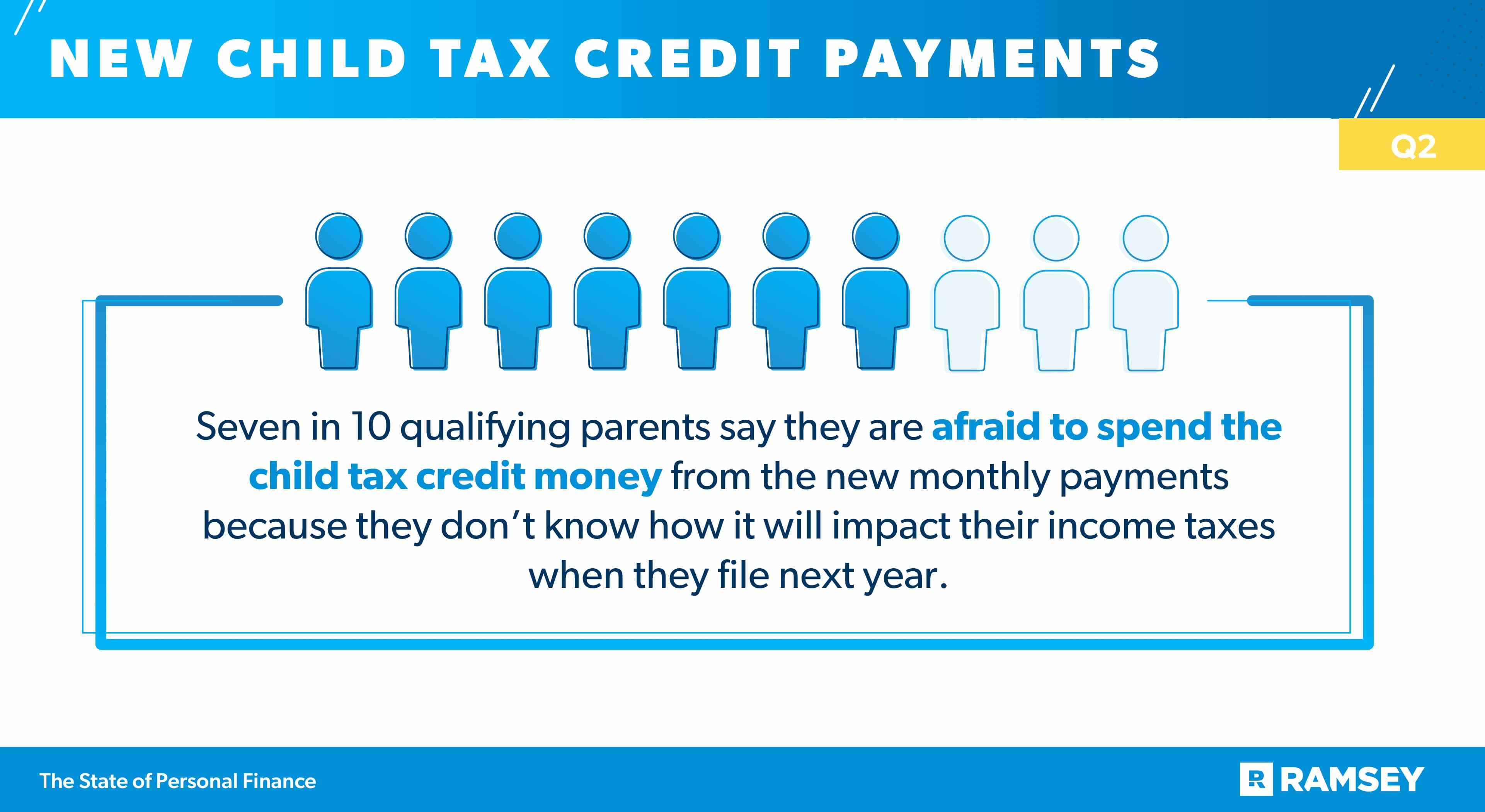

As Americans regained some normalcy over the summer, a new study finds consumers feeling like they’re better off financially than they were this time last year but still hesitant to ramp up their spending. Ramsey Solutions’ Q2 State of Personal Finance Study finds that external factors like inflation, child tax credit payments and the booming seller’s real estate market are the top money topics on people’s minds.

By Ramsey Solutions · Via Business Wire · August 9, 2021

High school students across the country have the chance to become money savvy adults when they take Foundations in Personal Finance: High School Edition, the comprehensive curriculum from Ramsey Education, a division of Ramsey Solutions. New data collected from more than 1 million Foundations students between 2017 and 2021 shows the financial literacy instruction is effective: Students’ pre-test and post test scores increased an average of 22 percentage points.

By Ramsey Solutions · Via Business Wire · July 26, 2021

“Take Back Your Time: The Guilt-Free Guide to Life Balance” by inspiring personal development expert, Ramsey Personality and No. 1 national bestselling author, Christy Wright, is now available for preorder. In her new book, Wright redefines what life balance is and offers a clear path to achieve it. Published by Ramsey Press, “Take You’re your Time” (ISBN: 9781942121565) will release on September 14, 2021, and retails for $19.99. You can find more information at christywright.com.

By Ramsey Solutions · Via Business Wire · July 12, 2021

The pandemic of 2020 wreaked a particular kind of havoc on Americans with debt. According to the Ramsey Solutions Q1 State of Personal Finance study, 42% of those with consumer debt say the pandemic has been a financial setback they don’t think they can come back from, compared to 27% of people without consumer debt.

By Ramsey Solutions · Via Business Wire · May 3, 2021

To celebrate small business owners, Ramsey Solutions is launching a giveaway during National Small Business Week.

By Ramsey Solutions · Via Business Wire · April 28, 2021