Latest News

Amazon has reportedly laid off at least 100 employees in its robotics division as part of a broader push to cut corporate costs and improve efficiency through AI, following earlier layoffs totaling about 30,000 roles and the cancellation of its Blue Jay robotics project.

Via Benzinga · March 4, 2026

Via Talk Markets · March 4, 2026

Leading cryptocurrencies staged a strong relief rally on Wednesday, while the stock market also closed higher even as the Middle East war entered its fifth day.

Via Benzinga · March 4, 2026

Innovative AI tools are making the website-building platform more valuable to users.

Via The Motley Fool · March 4, 2026

Even if Bitcoin ends the year in the red, it's still possible to turn a profit in crypto.

Via The Motley Fool · March 4, 2026

Via Talk Markets · March 4, 2026

Via Talk Markets · March 4, 2026

The Trump Administration’s focus on increasing the domestic supply of critical minerals has pumped United States Antimony’s stock in the last 12 months.

Via Stocktwits · March 4, 2026

The Information reported that the two companies held discussions as part of OpenAI’s plans to expand its ads significantly this year.

Via Stocktwits · March 4, 2026

Nokomis Capital initiated a new position in Apple Hospitality REIT, a hotel owner focused on upscale properties branded under Marriott and Hilton. As the lodging sector moves beyond its post-pandemic rebound, investors are watching whether room rates and occupancy can remain stable across a more normalized travel cycle.

Via The Motley Fool · March 4, 2026

Via Talk Markets · March 4, 2026

Via Talk Markets · March 4, 2026

The Dow Jones Industrial Average added 0.49% to 48,739.41, the S&P 500 advanced 0.78% to 6,869.50 on Wednesday.

Via Benzinga · March 4, 2026

AMD has had some impressive headlines lately. Nvidia is still the better AI buy.

Via The Motley Fool · March 4, 2026

Among the catalysts for Thursday are earnings from Kroger, Burlington Stores, BJ’s Wholesale, Costco and Marvell Technology.

Via Stocktwits · March 4, 2026

A crypto-friendly White House trumpeted a new measure that should boost digital coins and tokens.

Via The Motley Fool · March 4, 2026

Investors looking for insider buying activity (particularly from billionaires) may want to consider these three Canadian stocks right now.

Via The Motley Fool · March 4, 2026

A long-term focus and consistency are key to investing success.

Via The Motley Fool · March 4, 2026

This digital media company delivers online content, marketplaces, and services across multiple consumer-focused platforms.

Via The Motley Fool · March 4, 2026

Here's why long-term investors would be remiss to ignore Shopify (TSX:SHOP) as a top-tier growth stock to buy and hold forever in a TFSA.

Via The Motley Fool · March 4, 2026

The distributed gaming operator reported a solid fourth quarter.

Via The Motley Fool · March 4, 2026

Cross Country Healthcare (CCRN) Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Rigetti (RGTI) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Clearline Capital added shares of Core Scientific, a major Bitcoin mining operator with large-scale data center facilities. With mining rewards reduced after the latest halving, access to power and infrastructure is becoming the industry’s defining advantage.

Via The Motley Fool · March 4, 2026

Evercore ISI sees C.H. Robinson as a rare AI-era winner because its agentic supply chain platform is already turning 30‑plus AI agents loose on real freight tasks, helping it gain share, expand margins, and extend a 28‑year dividend growth streak.

Via Barchart.com · March 4, 2026

American Eagle (AEO) Q4 2025 Earnings Transcript

Via The Motley Fool · March 4, 2026

Hudson Technologies (HDSN) Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Could Oddity be the next breakout stock in the cosmetics and wellness sector? Join us as we evaluate its strengths, weaknesses, and future potential.

Via The Motley Fool · March 4, 2026

It's starting work on a very lucrative project.

Via The Motley Fool · March 4, 2026

Ooma (OOMA) Q4 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Not understanding it could cost you.

Via The Motley Fool · March 4, 2026

Broadcom (AVGO) Q1 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

For the full year 2027, the company expects total revenue of $3.17 billion to $3.19 billion, in line with an estimated $3.17 billion, and adjusted and diluted net income per share of $3.74 to $3.82, beating an estimate of $3.67.

Via Stocktwits · March 4, 2026

Okta (OKTA) Q4 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Veeva (VEEV) Q4 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

These top Canadian dividend stocks provide the sort of total return upside so many investors are looking for. Here's why they look like strong buys right now.

Via The Motley Fool · March 4, 2026

Business Insider reported the layoffs on Wednesday, citing a message from Amazon Robotics VP Scott Dresser.

Via Stocktwits · March 4, 2026

StubHub (STUB) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

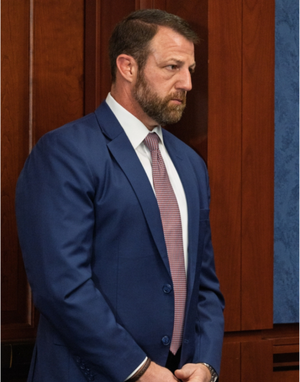

Sen. Markwayne Mullin has been buying shares of smaller companies in recent months. Here are his latest transactions and why one stock is catching attention.

Via Benzinga · March 4, 2026

PagSeguro (PAGS) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Buffett has proven his investing skills over the long term.

Via The Motley Fool · March 4, 2026

Via Benzinga · March 4, 2026

Perhaps the market isn't looking forward enough on this one.

Via The Motley Fool · March 4, 2026

Stem (STEM) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

TriplePoint (TPVG) Earnings Call Transcript

Via The Motley Fool · March 4, 2026