Ford Motor (F)

13.59

-0.21 (-1.52%)

NYSE · Last Trade: Feb 9th, 11:13 PM EST

Detailed Quote

| Previous Close | 13.80 |

|---|---|

| Open | 13.75 |

| Bid | 13.61 |

| Ask | 13.62 |

| Day's Range | 13.53 - 13.78 |

| 52 Week Range | 8.441 - 14.50 |

| Volume | 59,779,061 |

| Market Cap | 54.74B |

| PE Ratio (TTM) | 11.72 |

| EPS (TTM) | 1.2 |

| Dividend & Yield | 0.6000 (4.42%) |

| 1 Month Average Volume | 62,072,861 |

Chart

About Ford Motor (F)

Ford Motor Company is a global automotive industry leader known for designing, manufacturing, marketing, and servicing a wide range of vehicles, including cars, trucks, and SUVs. With a rich history of innovation, Ford is committed to producing high-quality vehicles that cater to the needs of consumers while also embracing advancements in technology and sustainability. The company is investing significantly in electric vehicles and smart mobility solutions, aiming to shape the future of transportation through eco-friendly practices and cutting-edge automotive technologies. Ford's brand is synonymous with reliability and performance, making it a prominent player in both the domestic and international automotive markets. Read More

News & Press Releases

Chegg (CHGG) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 9, 2026

Ford's pivot away from electric vehicles puts a focus on profits, and less focus on growth. What will the company say in Q4 results?

Via Benzinga · February 9, 2026

Looking for the most active stocks in the S&P500 index on Monday?chartmill.com

Via Chartmill · February 9, 2026

Kenwood Corporate Drive, an affiliate of Kenwood Management Company, announced today that it had completed a 2,508 sf lease with Activate Body at 8015 Corporate Drive in White Marsh, Maryland.

Via Get News · February 9, 2026

In a dramatic reversal of fortune for the beleaguered electric vehicle sector, Polestar Automotive Holding UK PLC (NASDAQ: PSNY) saw its shares skyrocket by nearly 32% on Friday, February 6, 2026. The surge, which propelled the stock to a closing price of $19.42, marks the company’s most significant

Via MarketMinute · February 9, 2026

Tesla, Inc. (NASDAQ: TSLA) finds itself at a defining moment in its corporate history following the release of its Q4 2025 earnings report. As of February 9, 2026, the market is grappling with a paradox: Tesla’s core automotive deliveries fell by roughly 9% in 2025, yet its stock price

Via MarketMinute · February 9, 2026

Unhealthy automakers have a date with a nightmare scenario if Chinese EVs sell in the U.S. anytime soon. It's also a massive opportunity -- here's how.

Via The Motley Fool · February 9, 2026

Lucid depends on the Gravity SUV for near-term volume and is targeting a $50,000 midsize model and a robotaxi program with Uber and Nuro for longer-term growth.

Via Stocktwits · February 9, 2026

Automotive manufacturer Ford (NYSE:F)

will be reporting earnings this Tuesday after market hours. Here’s what to expect.

Via StockStory · February 8, 2026

While tariff complications and EV profitability will continue to weigh on bottom lines, this automaker is still driving strong results.

Via The Motley Fool · February 8, 2026

The tech and auto sectors saw major moves as Uber hit 200 million monthly users, Waymo faced scrutiny over remote guidance and a federal safety probe, Ford explored a partnership with Geely, and Tesla pushed for national self-driving regulations.

Via Benzinga · February 8, 2026

Ford is cutting its EV truck, and Rivian is about to launch a new one.

Via The Motley Fool · February 7, 2026

Given the scope of the automotive sector, investors might be interested in Ford.

Via The Motley Fool · February 7, 2026

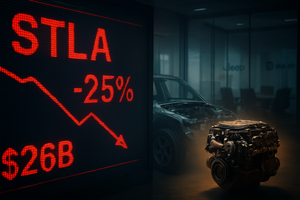

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

As the global automotive industry navigates a volatile transition toward electrification, Ford Motor Company (NYSE: F) finds itself at a defining crossroads. The Dearborn-based automaker is scheduled to release its fourth-quarter 2025 financial results on February 10, 2026, with Wall Street analysts laser-focused on a consensus earnings-per-share (EPS) estimate of

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

Stellantis grapples with a monumental EV setback—one analyst calls it the "biggest capital allocation mistake" in auto history—joining peers in massive write-downs while its undervalued stock draws cautious analyst optimism.

Via Barchart.com · February 6, 2026

What's going on in today's session: S&P500 most active stockschartmill.com

Via Chartmill · February 6, 2026

Stellantis stock crashes as management announces a €22.2 billion ($26.5 billion) impairment charge. Here’s why STLA shares are not worth owning following the valuation haircut.

Via Barchart.com · February 6, 2026

GM's financial performance in 2025 cut through a lot of industry noise, and what investors need to hear is clear.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the North American energy landscape has reached a historic inflection point. The frantic merger and acquisition (M&A) wave that gripped the industry between 2023 and 2025 has largely transitioned into an intensive integration phase, fundamentally reshaping the sector into a more concentrated market dominated

Via MarketMinute · February 6, 2026

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction As of early 2026, Tesla (Nasdaq: TSLA) finds itself at the most critical juncture since the 2018 "Model 3 production hell." No longer just a high-growth electric vehicle manufacturer, Tesla is aggressively rebranding itself as a "Physical AI" and robotics powerhouse. This transition comes at a time when its core [...]

Via Finterra · February 6, 2026

Date: February 6, 2026 Introduction The high-stakes world of prestige beauty was sent into a tailspin yesterday as The Estée Lauder Companies Inc. (NYSE: EL) witnessed a dramatic 19.2% collapse in its share price. The sell-off, which represents one of the steepest single-day declines in the company’s nearly 80-year history, came on the heels of [...]

Via Finterra · February 6, 2026